ARTICLE AD

Ethereum and Stellar power the US' massive tokenized treasury industry.

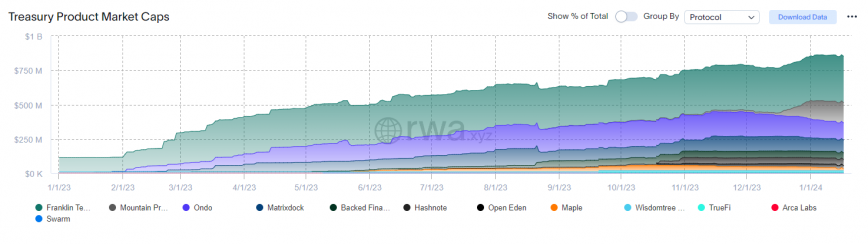

Recent data from the analytics company rwa.xyz reveals a 657% yearly growth in the market cap of tokenized US treasuries, reaching $863.6 million as of Jan. 18.

A tokenized US treasury is a digital representation of traditional financial instruments like government bonds, US treasuries, or cash equivalents on a blockchain.

The burgeoning industry is currently dominated by investment firm Franklin Templeton through its Franklin OnChain US Government Money Fund (FOBXX) mutual fund. FOBXX has successfully tokenized over $336 million in US government securities, cash, and repurchase agreements. Each share is valued at $1, and the majority of these tokens are issued on the Stellar blockchain, with a $2 million segment on Polygon.

Asset manager WisdomTree has also made strides using Stellar. WisdomTree’s Short-Term Treasury Digital Fund (WTSYX), which tracks the Solactive US 1-3 Year Treasury Bond Index, has seen more than $10 million in tokens sold to investors.

Tokenized US Treasuries’ total market cap and its players. Image: rwa.xyz

Tokenized US Treasuries’ total market cap and its players. Image: rwa.xyzAnother significant player is USDM, a dollar-backed stablecoin issued by Mountain Protocol, standing as the second-largest RWA with a market cap of nearly $149 million. Positioned as an “institutional-grade stablecoin,” USDM is built on the Ethereum blockchain and offers a 5% annual percentage yield.

Although the largest tokenized treasury issuer in the US uses Stellar’s blockchain infrastructure, Ethereum’s blockchain takes the spot of the largest network, representing almost $494 million, or over 57%, of the total market size. This figure surpasses Stellar’s market share by 43%, which stands at $344 million.

The expansion in market value is paralleled by the growth in the number of companies entering the tokenized treasury space. From just three firms a year ago, the industry now boasts 12 players, which might suggest interest in the tokenization of traditional financial assets in the US.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

81

1 year ago

81