ARTICLE AD

Investor sentiment in Bitcoin ETFs reflects a growing preference for the crypto over traditional gold despite both reaching unprecedented price levels.

Bitcoin and gold are often seen as protective measures against inflation and valuable assets, but this year has marked a notable divergence in investor behavior. Recent data reveals gold ETFs experienced withdrawals totaling approximately $4.6 billion.

Conversely, Bitcoin ETFs approved by the SEC on Jan. 11 witnessed $8 billion in net investments, marking a record debut for the financial instruments.

There is no second best! #Bitcoin absolutely demolishing gold and silver in ETF flows yesterday.

– Bitcoin ETFs: Inflow of $717mm

– Gold ETFs: Inflow of $32mm

– Silver ETFs: Outflow of $19mm

The flippening marches on. Tick tock! pic.twitter.com/iq9trncwZ6

The comparison between Bitcoin and tangible assets like gold, particularly in their non-yielding nature, has gained traction among investors, especially amid the low-interest rates observed during the Covid pandemic.

Recent trends suggest anticipations of monetary policy adjustments, global political uncertainties, and concerns over potential equity market downturns increasingly influence gold’s price movements.

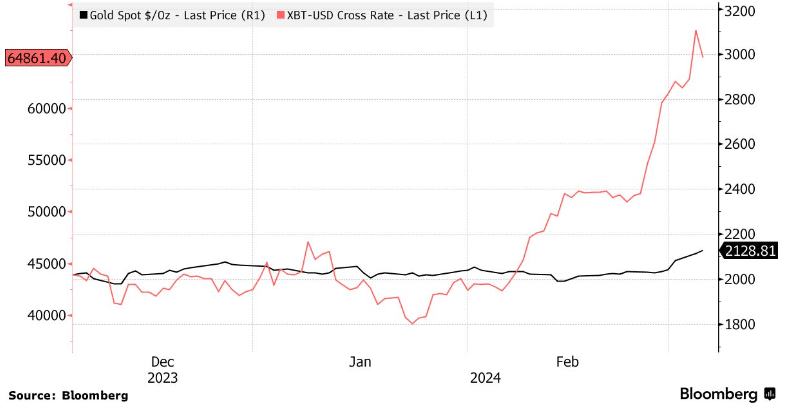

Both Bitcoin and Gold hit an all-time high today | Source: Bloomberg

Both Bitcoin and Gold hit an all-time high today | Source: Bloomberg

Bitcoin’s value soared to its highest point in over two years on Tuesday, though the peak was short-lived. The cryptocurrency’s price reached $69,191 before retracting approximately 6%, as investors decided to capitalize on the year’s significant gains, which amounted to around 60%.

Meanwhile, gold remains near its record-high price of $2,141, showcasing the contrasting investor confidence in the two assets amidst a volatile market.

8 months ago

44

8 months ago

44