ARTICLE AD

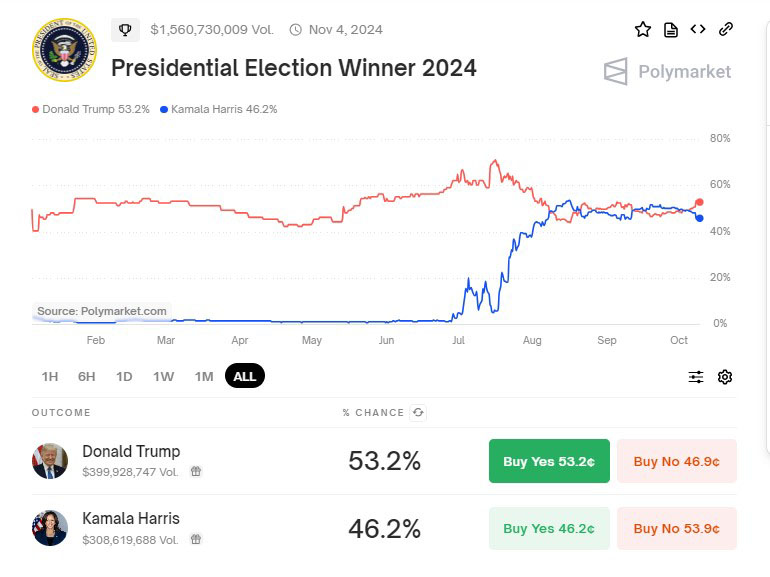

Polymarket betting platform has seen over $1.5 billion wagered on the US presidential election. Its odds lean toward Trump, likely due to his pro-crypto stance.

Key Notes

Trump's potential presidency could boost Bitcoin to $80,000-$90,000, driven by his pro-crypto stance and plans for Bitcoin mining in the nation.Harris victory might cause Bitcoin to drop to $40,000, reflecting her less detailed crypto policies and focus on consumer protection.Polymarket, a blockchain betting platform, shows Trump leading, with over $1.5 billion wagered on the United Nation presidential election outcome.As the US presidential election approaches, its effects on financial markets, particularly cryptocurrencies, are gaining attention. Donald Trump, presenting himself as a crypto supporter, has prompted analysts at Bernstein to restate their earlier forecast.

Bernstein predicts Bitcoin BTC $61 866 24h volatility: 1.4% Market cap: $1.22 T Vol. 24h: $27.05 B might surge to $80,000 or even $90,000 if Trump secures the presidency soon. This positive outlook is rooted in Trump’s favorable views on digital currencies. His plans include boosting Bitcoin mining in the US and selecting a Securities and Exchange Commission (SEC) chair with a pro-crypto mindset.

Harris Victory May Drop Bitcoin to $40K

Trump’s campaign has caught attention for its strong support of cryptocurrency. His team is accepting digital currency donations and pushing for a national Bitcoin reserve. These moves make it clear he favors integrating crypto into the US financial system.

On the other hand, Vice President Kamala Harris, while backing blockchain technology and digital assets, has not detailed her crypto policies as much. Her focus is more on protecting consumers and boosting America’s leadership in blockchain, fitting her broader “opportunity economy” agenda.

Analysts at Bernstein, including Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia, suggest that Trump’s win could push Bitcoin past its previous $74,000 peak. Meanwhile, they believe a Harris win might cause Bitcoin to drop to around $40,000, given current market trends and political uncertainties.

“In the scenario of a Trump win, we expect Bitcoin to touch a new high ($80K to $90K) exceeding its previous high of $74K. In case of a Harris win, in the near term, we believe it could test a new low in the $40Ks range (previously untested in the recent correction,” Gautam Chhugani, Mahika Sapra and Sanskar Chindalia said to clients on Wednesday

The Role of Polymarket and Election Odds

Polymarket, a blockchain betting platform, has seen over $1.5 billion wagered on the US presidential election. Its odds lean toward Trump, likely due to his pro-crypto stance. However, Bernstein analysts argue that despite some bias, the platform’s high liquidity and market engagement make it a reliable gauge of public opinion.

Source: Polymarket

While Bitcoin might react positively to increasing odds of a Trump victory, Bernstein analysts expect altcoins like Ethereum and Solana to remain more stable until after the elections. The future directions of these cryptocurrencies are likely to be influenced by the regulatory environment, which will become clearer with the appointment of new regulatory heads and their policies post-election.

The intersection of cryptocurrency trends and US presidential election outcomes is drawing significant attention, with potential high stakes for investors and the broader financial markets. As November 5 draws near, all eyes will be on these evolving dynamics and their implications for the cryptocurrency landscape.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Bitcoin News, Cryptocurrency News, News

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

1 month ago

10

1 month ago

10