ARTICLE AD

Uniswap Labs has announced that the waitlist for Uniswap Extension, its new browser-based wallet extension, is now open exclusively for those who have uni.eth usernames which can be obtained through the Ethereum Name Service (ENS).

Introducing the Uniswap Extension 🦄

The first wallet to live in your browser’s sidebar.

No more pop-ups. No more transaction windows.

Waitlist opens today 👇 pic.twitter.com/yNNgiju5zj

— Uniswap Labs 🦄 (@Uniswap) February 27, 2024

The announcement comes a couple of days after Uniswap Foundation, the non-profit group overseeing development for the Uniswap protocol, announced that it will be launching the decentralized exchange’s V4 upgrade by Q3 2024. This upgrade will be based on the Dencun upgrade from Ethereum and is aligned with Uniswap’s focus on self-custody and decentralization.

The native web browser extension will allow direct sending, receiving, buying, and swapping of tokens from within a web browser. This simplifies the Web3 experience for its decentralized exchange by removing the need to access from a separate app or sign in from another wallet like MetaMask.

According to Uniswap Labs, the extension is the “first wallet to live in your browser’s sidebar,” and would no longer require pop-ups or transaction windows. Initiatives like this can be seen as efforts at removing user reliance on third-party services for core functionalities, with the aim of significantly increasing accessibility as the decentralized finance sector expands its reach.

To date, over 100,000 uni.eth subdomains have been claimed for free through the Uniswap mobile app, which is available for both iOS and Android users. Note, though, that usernames are only available on version 1.21.1 or higher of the Uniswap Wallet.

These developments follow what the Uniswap Foundation announced over a week ago: a proposal to change the reward system for staking and delegation radically. In this proposal, Uniswap seeks to address concerns of stagnation from its protocol by prioritizing rewards for “active, engaged, and thoughtful” users.

The decentralized exchange also recently executed a canonical deployment of its Uniswap v2 on Arbitrum, Polygon, Optimism, Base, Binance Smart Chain, and Avalanche, enabling direct swapping and liquidity pool creation from its native interface.

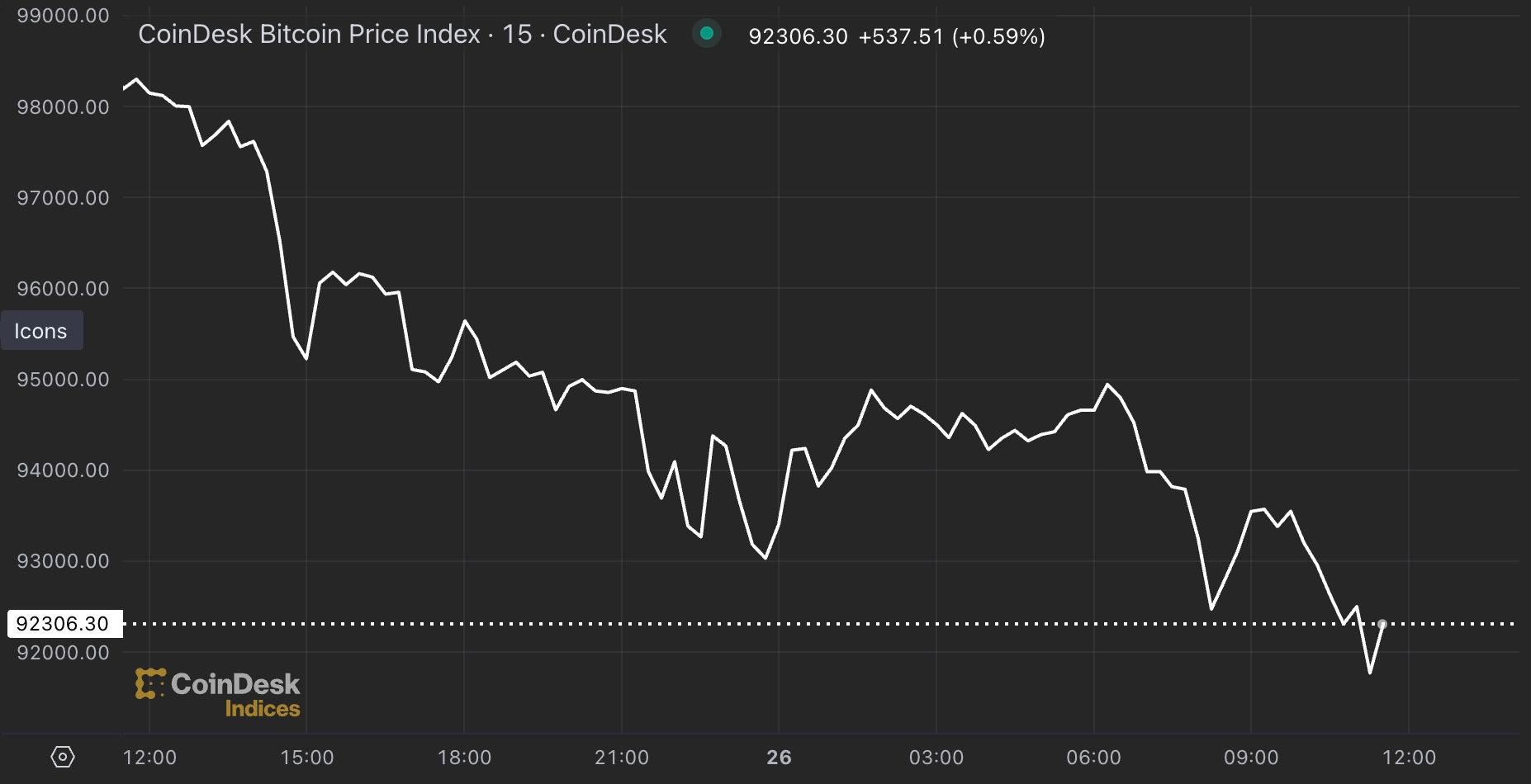

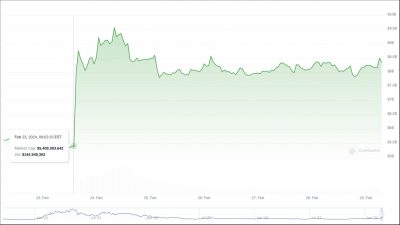

UNI, the protocol’s native token, has seen a 51.2% uptick over the past week. Reading data from CoinGecko, a significant change can be seen on the decentralized exchange’s volume between February 23 and 24. From a 24-hour average of $105 million, the DEX suddenly saw $2 billion in trading volume. By February 25, it has dwindled to $1.5 billion, with current data showing $539 million.

This change in volume also reflects on the protocol’s market capitalization, which went from $5.5 billion to $8.5 billion in the same time frame shown in the chart above.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

8 months ago

36

8 months ago

36