ARTICLE AD

Previously, the firm charged a flat fee of 0.15%.

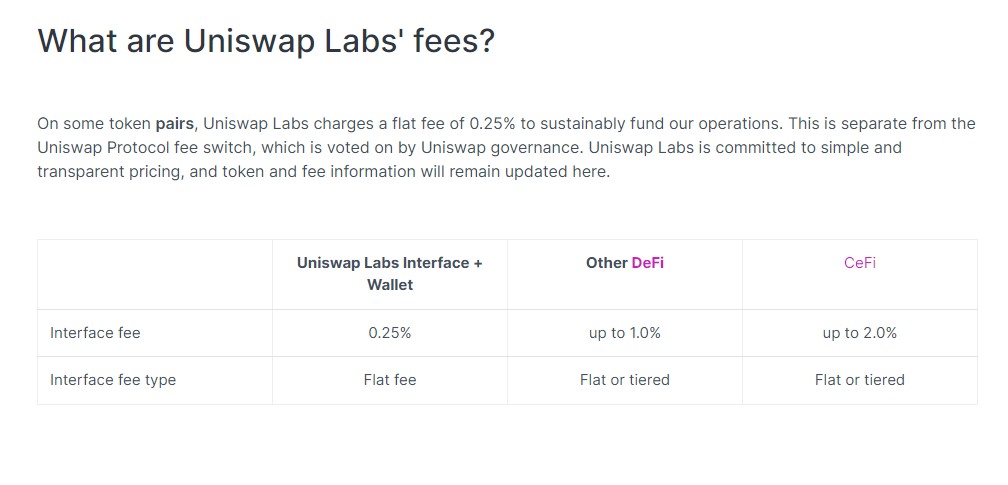

Uniswap Labs has imposed a new swap fee of 0.25%, starting on April 10, the same day the firm’s founder, Hayden Adams, disclosed that they received a Wells notice from the US Securities and Exchange Commission (SEC).

According to Uniswap Labs’ latest update, the fee applies to a broad range of trading pairs, with some exceptions for stablecoin and wrapped token pairs, and is in effect across all networks that support Uniswap. Users have the option to bypass this fee by using alternative interfaces that are not developed by Uniswap Labs.

Uniswap rolled out the swap fees around mid-October last year. At the time, the firm charged a flat fee of 0.15%, citing that it was part of a strategy for the company’s sustainable growth.

Following the first announcement, the Uniswap community responded dividedly to the introduction of these fees. While some members supported the decision for the project’s sustainability, others were displeased with the additional cost.

Before the implementation of the interface fee, the only cost to Uniswap users was the protocol fee.

Although the noted reason for the fee is to ensure Uniswap operates sustainably, there is speculation that it could also help cover legal expenses in the event of a fight with the SEC.

Uniswap Labs also noted that the interface fee is separate from the Uniswap Protocol fee switch. Previously, in March, Uniswap issued a new proposal to distribute swap fee income to holders of its native UNI token.

According to CoinGecko’s data, the UNI token’s price dropped to around $7.4, down around 34% over the past week following the SEC’s legal threat and the overall downward trend in the crypto market last weekend.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

48

7 months ago

48