ARTICLE AD

Uniswap's 0.15% swap fee generates a millionaire amount in revenue amid community debate over VC interests.

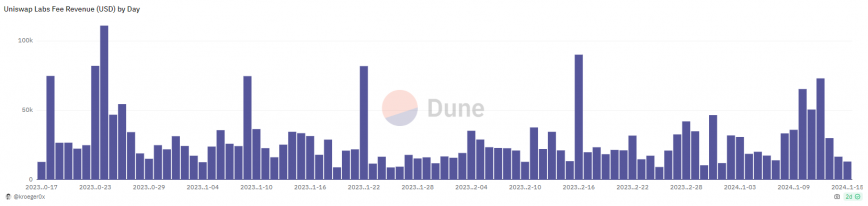

Decentralized exchange (DEX) Uniswap has amassed over $2.6 million in fees for the last three months, according to a Dune Analytics dashboard created by backend engineer Alex Kroeger.

Since Oct. 17, 2023, users who make any swap consisting of two out of 11 crypto assets through the DEX’s interface developed by Uniswap Labs started being charged a 0.15% fee on top of the swapped amount. Stablecoins tied to the same underlying asset and wraps between ETH and WETH were not included. The fees were announced by Uniswap Labs founder Hayden Adams that same month as part of a program to foster Uniswap’s ecosystem growth.

Despite the justification presented by Adams, some members of the crypto community took to X (formerly Twitter) to manifest their disapproval. They accused Uniswap Labs’ founder of acting in the interests of the venture capital (VC) funds that invested in the DEX, citing rumors that the new revenue stream would be shared with VCs.

Moreover, the UNI token native to the DEX initially had a revenue-sharing model at its inception, called ‘fee switch’, which would share part of the fees charged by Uniswap Labs with the token holders. Yet, it never came live on worries that UNI would be considered a security by the SEC.

The move was expected to generate a ‘trust crisis’ towards Uniswap, leading to falling volumes. However, three months after the implementation of the interface fee, Uniswap still dominates more than 35% of decentralized finance (DeFi) crypto trading volume, according to DefiLlama. Also, it seems like no one is talking about the incident anymore.

A fair fee

Charging fees for a provided service is something expected in a protocol, to try to create a sustainable product and not just live off governance tokens, says the research analyst at research firm Paradigma Education who identifies himself as Guiriba.

“Therefore, charging a fee for the swap is not necessarily a problem. It has already achieved the ‘network effect’, like Lido, for example. This gives it the freedom to not provide a service for free because its user base has already been built,” adds Guiriba.

The criticism directed at Uniswap Labs for charging a 0.15% fee on swaps and not sharing it with UNI holders, due to regulatory issues, won’t be able to impact Uniswap’s leadership in volume “for a long time”, weighs in the research analyst.

Besides, users can just use alternative solutions to interact with Uniswap, like the CoW Swap, DefiLlama, and 1inch aggregators, which are labeled by Guiriba as more efficient.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

88

1 year ago

88