ARTICLE AD

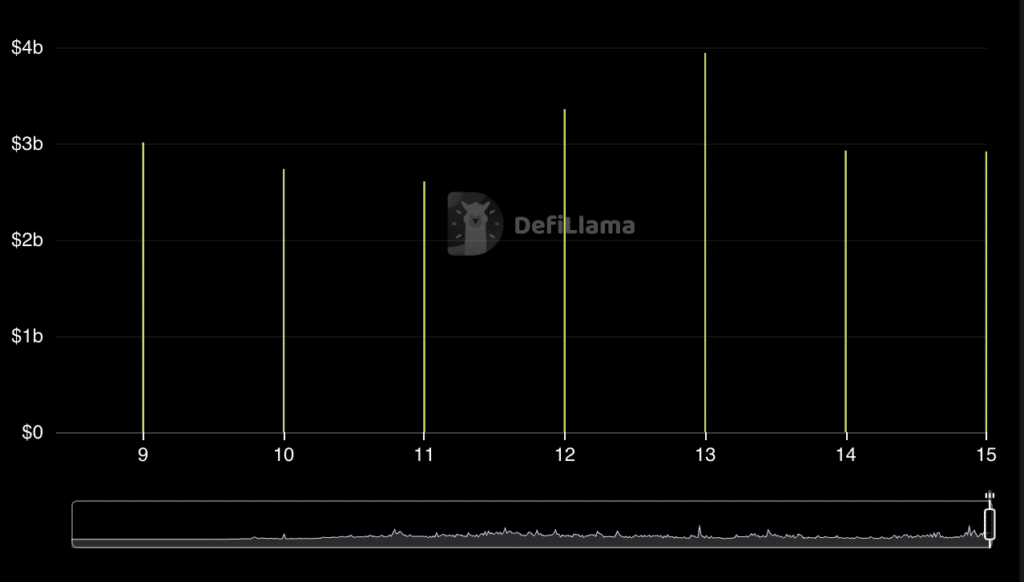

The average daily trading volume on the Uniswap decentralized exchange has approached $3 billion over the past week.

According to DefiLlama, between April 10 and April 15, Uniswap’s average daily trading volume was $3.08 billion.

Breaking the $3 billion mark indicates that DEX did not record a decline in the indicator amid news of a possible legal confrontation with the U.S. SEC.

Source: DefiLlama

Source: DefiLlama

According to available statistics, the increased risk of legal confrontation with the SEC has not deterred users. There was no significant decline in trading volume; this figure has remained from $2.6 billion to $3.9 billion for the last five days.

As of April 16, the total value locked (TVL) was $6.62 billion, and the platform’s market capitalization was $5.65 billion.

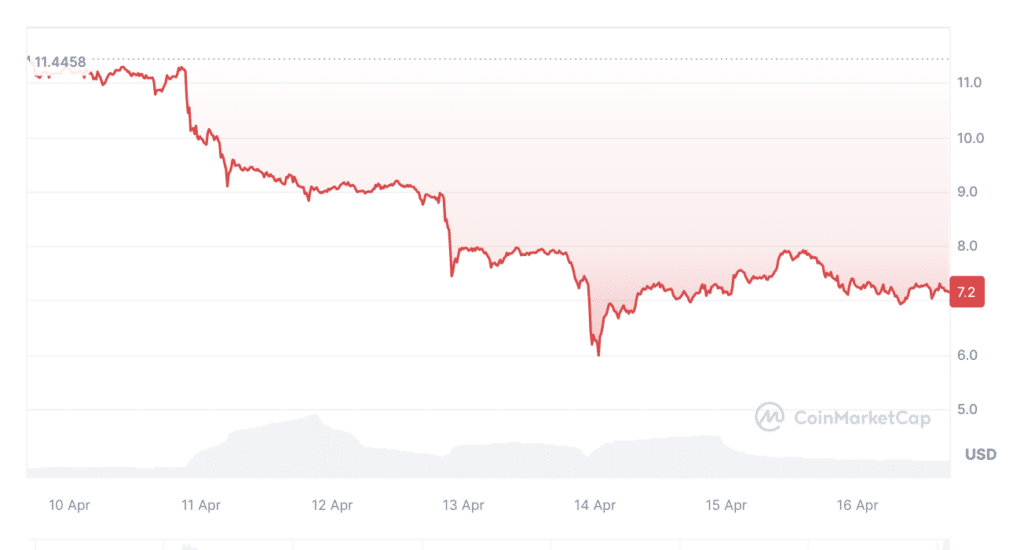

However, the Uniswap token (UNI) rate has not boasted positive dynamics. Over the past week, the token’s value fell by 37.5%, according to CoinMarketCap. On April 10, the UNI price was $11, but dropped below $6 three days later. At the time of writing, UNI is trading at $7.15, having fallen in price by 8% over the last 24 hours.

Source: CoinMarketCap

Source: CoinMarketCap

On April 10, Uniswap CEO Hayden Adams stated that the agency had provided his team with a Wells notice. Typically, such a letter is sent before filing a formal lawsuit or to give a final opportunity to refute any allegations.

The exchange also increased its commissions after news of a possible SEC lawsuit from 0.15% to 0.25%.

7 months ago

16

7 months ago

16