ARTICLE AD

Fidelity's Bitcoin Fund led with $63 million in inflows, boosting total to $9.5 billion.

Key Takeaways

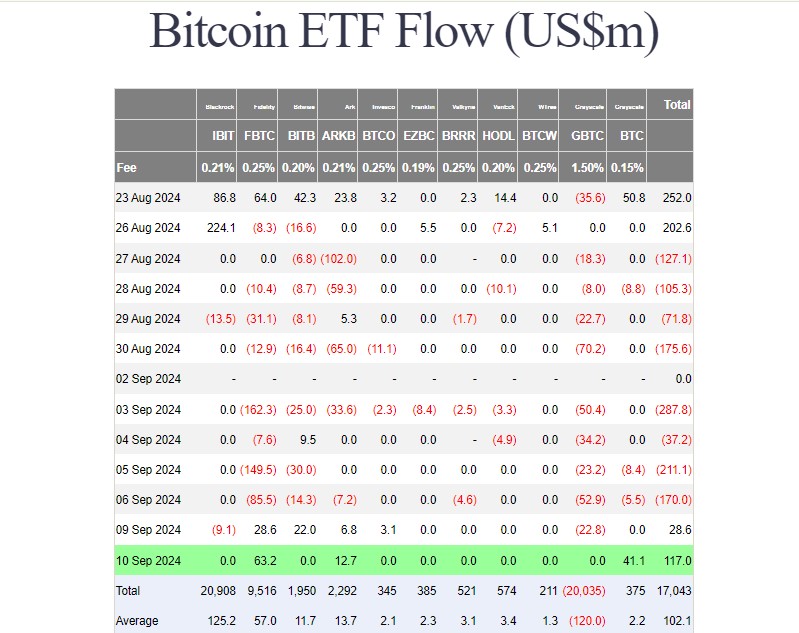

Spot Bitcoin ETFs collectively captured $117 million in net inflows on Tuesday. BlackRock's iShares Bitcoin Trust sees stagnation, no new capital since late August. <?xml encoding="UTF-8"?>Roughly $117 million was pumped into US spot Bitcoin exchange-traded funds (ETFs) in Tuesday trading, while the group of nine spot Ethereum ETFs was back in green after a period of losses, data from Farside Investors shows.

Source: Farside Investors

Source: Farside InvestorsFidelity’s Bitcoin Fund (FBTC) led the pack with around $63 million in net inflows on Tuesday. The gain boosts its total net inflows to $9.5 billion after 8 trading months.

At present, FBTC holds $10.5 billion worth of Bitcoin and is the third-largest Bitcoin ETF behind BlackRock’s iShares Bitcoin Trust (IBIT) and Grayscale’s Bitcoin Trust (GBTC).

Grayscale’s Bitcoin Mini Trust (BTC), GBTC’s low-cost version, and ARK Invest/21Shares’ Bitcoin ETF (ARKB), also ended yesterday successfully, attracting about $41 million and nearly $13 million in net capital, respectively.

Meanwhile, IBIT, GBTC, and the rest of the Bitcoin ETF group saw zero flows.

Net inflows started resuming on Monday after a prolonged period of outflows from late August to early September. During the outflow streak, over $1 billion was withdrawn from these funds. BlackRock’s Bitcoin fund also experienced its second outflow since its January launch.

Despite BlackRock’s iShares Bitcoin Trust (IBIT) experiencing its third day of outflows on Monday, US spot Bitcoin ETFs still managed to close in the green due to inflows into other funds.

Notably, IBIT has not reported any net capital since August 27, marking one of the longest stagnation periods since its debut.

Yet, some minor setbacks do not challenge IBIT’s market leadership. The fund remains a dominant force in the crypto ETF market, with holdings exceeding $20 billion.

Elsewhere, US spot Ethereum ETFs made a soft comeback with around $11 million in net inflows on Tuesday, Farside’s data shows.

Source: Farside Investors

Source: Farside InvestorsFunds that saw gains were Fidelity’s Ethereum Fund (FETH) and BlackRock’s iShares Ethereum Trust (ETHA). Other competing Ethereum ETFs saw zero flows.

Disclaimer

2 months ago

22

2 months ago

22