ARTICLE AD

Meanwhile, Bitcoin’s price is 6% away from its record high, currently trading at around $69,100.

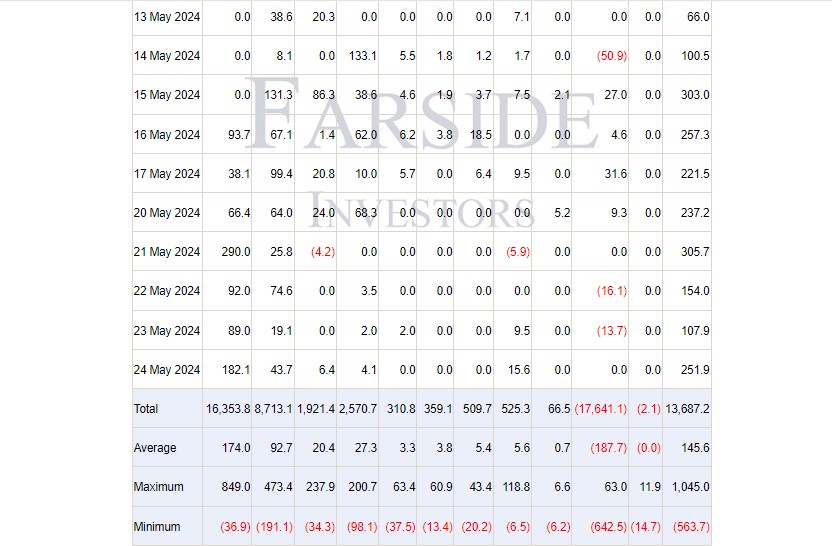

Investors have poured around $2 billion into US spot Bitcoin exchange-traded funds (ETFs) over the past two weeks, according to data from Farside. These funds also recorded a tenth consecutive day of net inflows.

This week alone, US spot Bitcoin ETFs saw over $1 billion in inflows, with Thursday recording the largest daily inflow of around $305 million.

BlackRock’s Bitcoin ETF, iShares Bitcoin Trust (IBIT), led the pack with nearly $720 million in weekly inflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) took the second spot with around $227 million.

US Spot Bitcoin ETF Inflows – May 13-24 – Farside

US Spot Bitcoin ETF Inflows – May 13-24 – FarsideThe order was different last week when FBTC surpassed IBIT in terms of weekly inflows. Data shows that FBTC recorded around $344 million in inflows from May 13 to 17 while IBIT saw approximately $132 million.

With over 284,525 BTC in its holdings, IBIT is just $300 million away from surpassing Grayscale Bitcoin Trust, which currently holds 289 BTC, valued at $19.9 billion. This calculation is based on Bitcoin (BTC) being worth $69,100 as of the writing, according to CoinGecko. IBIT is well on track to become the largest Bitcoin ETF.

Meanwhile, Bitcoin’s price moved in the same direction with strong ETF inflows in the last two weeks.

On May 24, this week’s final trading day, the price soared to $69,000, up around 13% over the past two weeks. Bitcoin is now only 6% away from its record high of $73,700, established in March.

Bitcoin had stagnated after the fourth halving, which analyst Rekt Capital pointed out as the post-halving “danger zone” characterized by heightened volatility. He noted last week, however, that the selling pressure was weakening; Bitcoin was entering a phase of accumulation.

In addition to Bitcoin ETFs, the week’s spotlight was on the SEC’s approval of spot Ethereum ETF filings. These ETFs still need S-1 form approval to begin trading, which ETF experts believe will take weeks to months. However, in essence, the approval of spot Ethereum ETFs indicates that the launch of these funds is imminent.

Positive developments prior to the approval had factored into the surge in Ethereum’s price (ETH). On Monday, ETH jumped 8% on news that approval odds were raised to 75%. Rally extended during the day with a broader market upswing. At press time, ETH is trading at around $3,700, up over 20% over the past seven days.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

51

7 months ago

51