ARTICLE AD

BlackRock's Ethereum Trust leads with strong inflows amid overall market challenges.

Key Takeaways

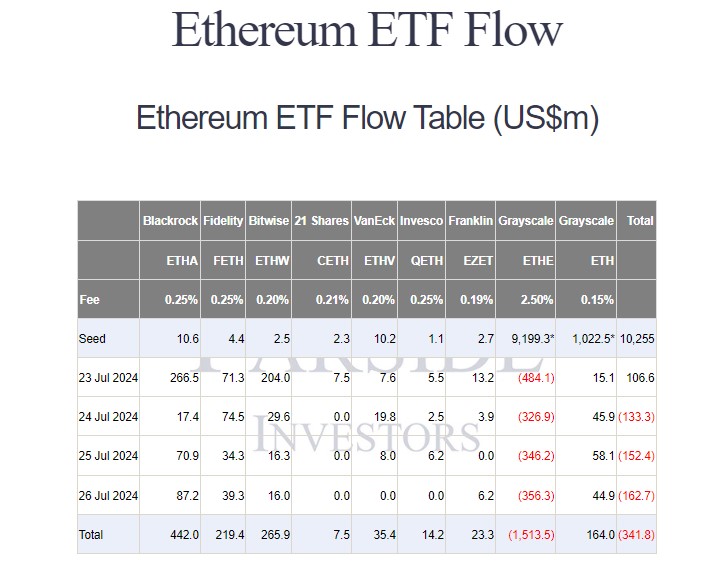

Grayscale's Ethereum Trust has experienced $1.5 billion in net outflows since it was converted into an ETF. BlackRock's Ethereum Trust has attracted $442 million, leading the net inflows among new US Ethereum ETFs. <?xml encoding="UTF-8"?>Newly launched US spot Ethereum exchange-traded funds (ETFs) were off to a rough start as investors pulled approximately $1.5 billion from Grayscale’s fund after the first week of trading, data from Farside Investors shows. These ETFs ended the week with almost $342 million in net outflows, with BlackRock’s Ethereum Trust leading the first-week inflows, drawing $442 million.

The $9.1 billion Grayscale Ethereum Trust (ETHE) saw over $450 million in trading volume on Tuesday, accounting for nearly half of the total trading activity. Farside’s data later revealed that investors withdrew over $480 million from the ETF on its first trading day as an ETF.

However, with $590 million flowing into other ETFs, largely driven by BlackRock’s iShares Ethereum Trust (ETHA), all US spot Ethereum ETFs still ended their first day strongly, attracting nearly $107 million in total inflows.

Ethereum ETF flows reversed course sharply after a strong debut, bleeding $133 million on Wednesday, July 24, followed by further losses of $152 million and $162 million on Thursday and Friday, respectively.

Overall, Grayscale’s ETHE has seen net outflows of about $1.5 billion since its conversion. In contrast, the newly launched spot Ethereum ETFs have attracted investor interest. BlackRock’s ETHA leads the pack with $442 million in inflows, followed by Bitwise’s ETHW at $265 million and Fidelity’s FETH at $219 million.

While Grayscale’s ETHE has suffered intense outflows, its Ethereum Mini Trust (ETH), the trust’s spinoff, has seen its net inflows steadily grow over the past week. Investors have poured around $164 million into the fund since launch.

Flow data suggests investors are reallocating assets from ETHE to lower-cost alternatives, and the Mini Trust has evidently positioned itself as a timely and attractive option.

Other Ethereum funds reporting inflows were VanEck’s ETHV, Franklin Templeton’s EZET, Invesco/Galaxy’s QETH, and 21Shares’ CETH.

As the Ethereum ETF market is entering its second week, Grayscale’s ETHE is expected to continue experiencing outflows.

According to Bloomberg ETF analyst Eric Balchunas, while the new Ethereum ETFs are attracting inflows and volume, they are currently less effective at offsetting the massive outflows from Grayscale’s ETHE compared to the impact of Bitcoin ETFs on Grayscale’s Bitcoin Trust (GBTC).

He expects the situation to improve over time, but the next few days could be difficult due to ongoing ETHE outflows.

Ethereum’s multiplier effect lags behind Bitcoin

Unlike Bitcoin, Ethereum’s (ETH) market capitalization is less sensitive to new investment inflows. CryptoQuant’s report indicated. Ethereum’s spot trading volume on centralized exchanges is significantly lower than Bitcoin’s, indicating less market activity.

Meanwhile, the Dencun upgrade has led to a rise in Ethereum’s supply, diminishing its deflationary nature and impacting its “ultrasound money” narrative. All those factors potentially hinder Ethereum’s price performance.

According to CoinGecko’s data, ETH was down over 10% following the spot Ethereum ETF debut, hitting a low of $3,100. At press time, ETH is trading at around $3,300, up over 4% in the last 24 hours.

Disclaimer

4 months ago

19

4 months ago

19