ARTICLE AD

The Bitcoin ETF market continues to see new competitors. Hashdex, a crypto asset management firm, announced its futures fund’s transformation into a spot product.

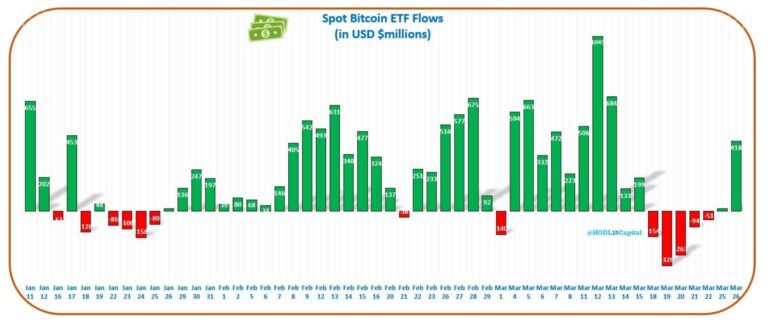

After a brief period of investor jitters, the US spot market for Bitcoin exchange-traded funds (ETFs) seems to be back on track. These recently launched investment products witnessed a total inflow of $418 million on March 26th, according to the HODL15Capital. This upbeat trend emerges after five successive days experienced net outflows from these funds.

Source: HODL15Capital

Source: HODL15Capital

Fidelity’s Bitcoin ETF soared as the standout performer, registering its most substantial daily inflow since March 13th. The investment giant injected an impressive $279.1 million into the fund, securing approximately 4,000 BTC. Notably, this marks the second consecutive day where Fidelity’s ETF has attracted inflows surpassing $260 million, underscoring its remarkable performance.

BlackRock’s product garnered substantial investment totaling $162.2 million. However, the daily inflows haven’t attained the remarkable levels witnessed in March, which averaged more than $300 million on a daily basis.

Fidelity and BlackRock lead the pack, yet other participants also experienced affirmative inflows. For instance, Ark 21Shares’ Bitcoin ETF attracted $73.6 million on its optimal day on March 12th. Invesco Galaxy, Franklin Templeton, and Valkyrie each secured inflows exceeding $26 million for their respective funds, marking a notable achievement.

Grayscale Witnesses $212 Million Outflows Amid Bitcoin ETF Surge

Despite the positive sentiment in the ETF market, Bitcoin Trust from Grayscale (GBTC) witnessed an outflow totaling $212 million. Although significant, this negative movement failed to counterbalance the net inflows recorded by competing ETF providers. The Trust’s continued downward trajectory contrasted with the overall upbeat outlook in the broader ETF market.

Among the remarkable performance of the newly launched Bitcoin ETFs. Grayscale, converting to an ETF model on January 11th, witnessed a notable decrease in its holdings, shedding a substantial 277,393 BTC, approximately equivalent to $19.5 billion at current rates, showing a significant transformation.

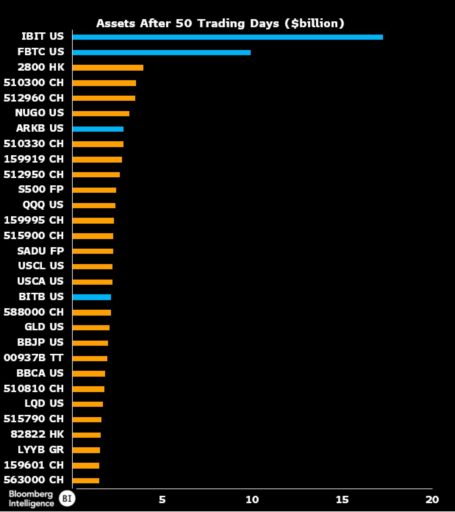

A recent analysis by Bloomberg’s Eric Balchunas underscored ETF’s popularity, featuring four Bitcoin ETFs among the top 30 asset funds in their initial 50 trading days. Notably, BlackRock’s IBIT and Fidelity’s FBTC stood out within this group, demonstrating sustained investor interest in these innovative financial instruments.

Source: Bloomberg Intelligence

Source: Bloomberg Intelligence

Furthermore, Balchunas highlighted that BITB, an ETF tracking Bitcoin and currently 18th by assets, has exceeded GLD – the world’s biggest gold ETF – underscoring Bitcoin’s rising prominence as an investable asset class despite its volatility and regulatory uncertainties.

Hashdex Joins the ETF Race

The Bitcoin ETF market continues to see new competitors. Hashdex, a crypto asset management firm, announced its futures fund’s transformation into a spot product on March 26. Trading under the ticker DEFI, the move marks the eleventh spot Bitcoin ETF launch within the United States, showing the sector’s growing landscape.

DEFI’s renaming aligns with its transition to offer direct Bitcoin exposure and track a novel benchmark index, taking effect on March 27, 2024. This change reflects DEFI’s evolved investment approach, permitting the Fund to hold Bitcoin directly while monitoring a different reference index.

Cryptocurrency interest is on the rise according to inflows into Bitcoin exchange-traded funds (ETFs). Though a novel market, these investment vehicles show early potential. With ongoing regulatory changes and growing investor familiarity with ETF structures, the trajectory of crypto ETFs will be noteworthy.

9 months ago

57

9 months ago

57