ARTICLE AD

Circle’s stablecoin has overtaken USDT to become the market leader in transaction volume.

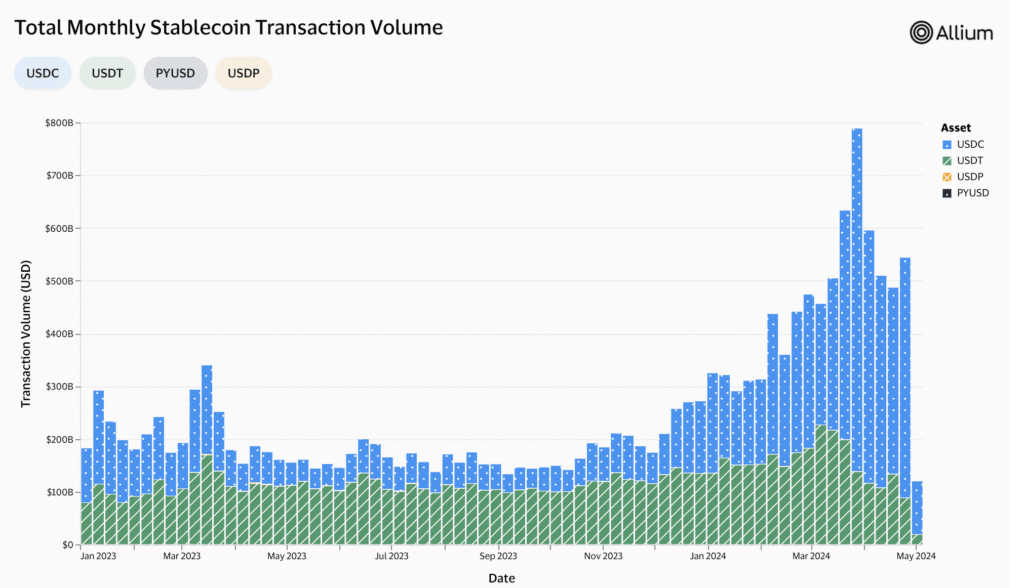

Circle’s USD Coin (USDC) has surpassed its largest competitor, Tether (USDT), in transaction volume this year, according to data from payment giant Visa and blockchain analytics platform Allium Labs.

Visa metrics show that USDC transaction volume was $455.5 billion last week, as USDT barely exceeded $88.5 billion.

Source: Visa

Source: Visa

Since the beginning of 2024, USD Coin has accounted for about 50% of the total volume of transfers in the stablecoin market. Previously, the leading position was always occupied by USDT, the largest stablecoin by capitalization. According to DefiLlama, the market share of Tether’s stablecoin is estimated at 69%. However, USDC performance hints at a possible shift in user sentiment.

As Bloomberg writes, citing cryptocurrency analyst Noelle Acheson, the change in the balance of power may be explained by the fact that USDT is used more outside the U.S. as a dollar store of value, while USDC is used in the country for regular transactions.

“USDT is more held outside the US as a dollar-based store of value, while the USDC is used in the US as a transaction currency.”

Noelle Acheson, cryptocurrency analystLast week, Stripe, the online payments leader, reintroduced cryptocurrency transfers. The platform began accepting USDC on three networks: Solana, Ethereum, and Polygon.

Additionally, issuer Circle has also joined the largest asset manager, BlackRock. The latter launched its first tokenized fund at the end of March. With the cooperation of the companies, the fund’s clients could convert BUIDL into USDC on the secondary market.

7 months ago

34

7 months ago

34