ARTICLE AD

Ethereum's revenue surpasses major platforms, signaling a shift in digital economy dynamics, says the asset manager in a recent report.

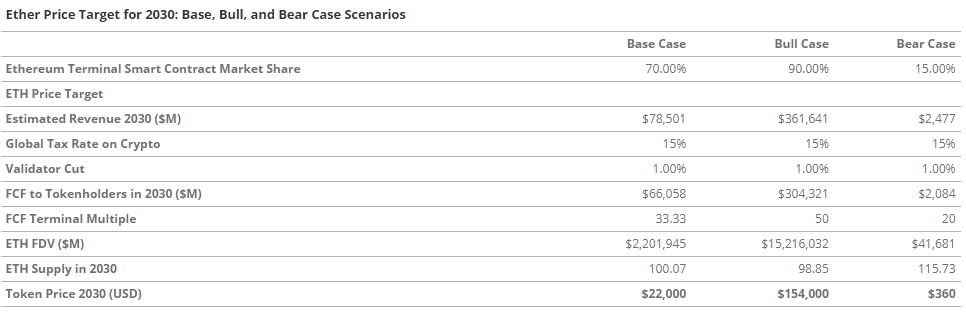

Asset manager VanEck projected the Ethereum (ETH) at $22,000 by 2030, according to a recent report. This represents a 487% increase from current levels, and VanEck bases its forecast on Ethereum’s anticipated generation of $66 billion in “free cashflows.”

The report puts a heavy weight into Ethereum’s stablecoin landscape, as the blockchain settled $4 trillion in stablecoins over the past year, along with the facilitation of $5.5 trillion in these tokens. Additionally, the stablecoin market cap in Ethereum is at over $91 billion.

“Compared to Web2 applications, Ethereum ($3.4B) generates more revenue than Etsy ($2.7B), Twitch ($2.6B) and Roblox ($2.7B) […] Ethereum is a vibrant economic platform that can be considered a “Digital Mall” whose usership has grown ~1500%, and revenue has surged at a 161% CAGR since 2019,” adds the document.

Notably, the recent approval of spot Ethereum exchange-traded funds (ETF) in the US also motivated the asset manager to evaluate their price prediction.

VanEck also recognizes Ethereum’s potential in the artificial intelligence (AI) sector, mentioning the inclusion of the AI end-market in the updated valuation model. The network’s infrastructure is expected to play a crucial role in the burgeoning AI economy, offering unique properties that are essential for the development of AI applications.

VanEck’s Ethereum evaluation framework. Image: VanEck

VanEck’s Ethereum evaluation framework. Image: VanEckFurthermore, the asset manager also mentions that Ethereum’s impact extends beyond its financial capabilities, as it enables the creation of more engaging and lucrative applications for entrepreneurs through its permissionless and open-source environment.

As a result, VanEck estimates Ethereum is projected to derive 71% of its revenues from financial businesses by 2030, with other sectors like AI expected to contribute significantly to its revenue stream.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

3 months ago

44

3 months ago

44