ARTICLE AD

The new product offers institutional-grade Bitcoin access and security.

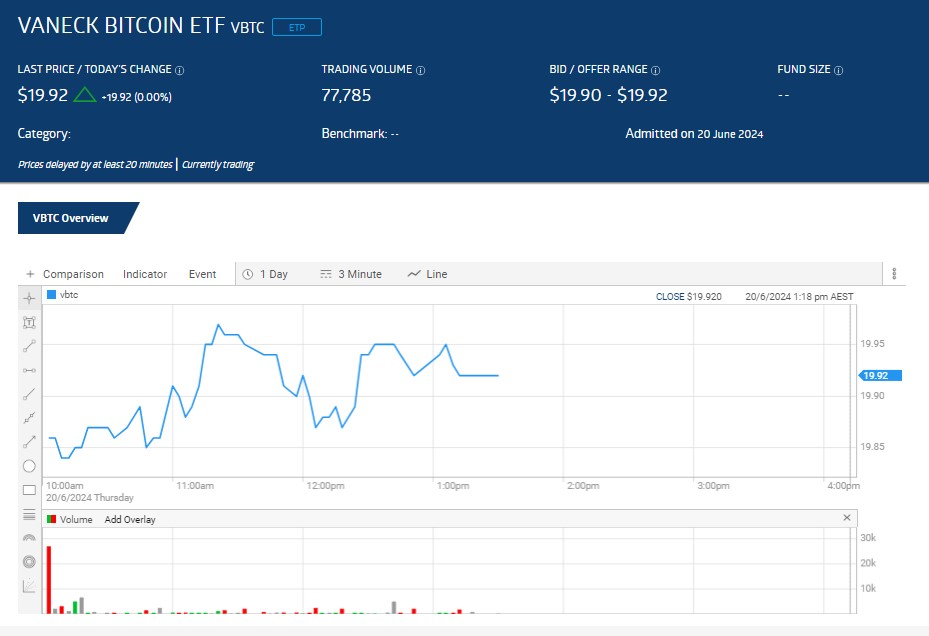

VanEck’s spot Bitcoin exchange-traded fund (ETF) is now live on the Australian Securities Exchange (ASX), the leading exchange in Australia. The fund’s trading volume surpassed $1.5 million after a couple of hours of trading.

VanEck Bitcoin ETF debuts on the ASX – Source: ASX

VanEck Bitcoin ETF debuts on the ASX – Source: ASXThe trading debut comes after the ASX approved the product listing under the ticker VBTC on Monday. VBTC is also the first spot Bitcoin ETF on the ASX.

The ASX is a key player in Australia’s capital markets, handling about 80% of equity trading, according to Bloomberg. The ETF, which acts as a feeder fund for the US-based VanEck Bitcoin Trust, started with an initial seed investment of approximately A$985,000.

“[VBTC] will present the price of Bitcoin. What we’ll give investors is really institutional-grade access to Bitcoin,” said Jamie Hannah, VanEck’s Deputy Head of Investments and Capital Markets.

“There are a lot of security measures in place as well as insurance…And it’s also extraordinarily low cost,” he noted, adding that customers can access VBTC through any retail broker.

Besides VanEck, other ETF issuers, Sydney-based BetaShares Holdings Pty and DigitalX Ltd. are planning to list their ETFs on the ASX.

Another major Australian exchange, CBOE Australia, already offers crypto ETFs. Global X 21Shares Bitcoin, Global X 21Shares Ethereum, and Monochrome Bitcoin have approximately $90 million combined assets.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight - and oversight - of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

7 months ago

50

7 months ago

50