ARTICLE AD

Vitalik Buterin responded to reports of Ethereum community members bemoaning the switch from the old proof-of-work model to a proof-of-stake consensus.

Amanda Cassatt, founder, and CEO of web3 marketing studio Serotonin, tweeted that several Ethereum (ETH) proponents were dissatisfied with the network’s current state. Cassatt stressed that the views were not personal and the posts mirrored conversations she was privy to.

The crypto founder also listed reasons opinionated by some community members.

“Been interesting to notice a lot of Ethereum community members privately expressing the wish that it had stuck with pow instead of transitioning to PoS.”

Amanda Cassatt, Serotonin Founder and CEOAlso 3. Being connected to the real world, so the price of energy to power mining factors into the network

— amanda.eth (@amandacassatt) April 26, 2024Ethereum co-creator Vitalik Buterin chimed into the conversation, highlighting that the proof of work (PoW) design held drawbacks that misaligned with the network’s long-term vision.

PoW was also quite centralized. It was just not talked about as much, because everyone knew it was only a temporary stage until PoS.

And that doesn't even get into how we probably mostly avoided ASICs only because the upcoming PoS switch meant no incentive to build them. pic.twitter.com/OhaqmRiiGJ

Since its genesis block in July 2015, crypto’s second-largest blockchain, Ethereum, adopted a PoW consensus mechanism similar to Bitcoin (BTC). Miners were key players under this model, contributing to network security and ETH emissions to allow new tokens to enter circulation.

This changed after “The Merge” in September 2022 when Ethereum moved to a proof-of-stake (PoS) infrastructure, replacing miners with stakers in a massive technological overhaul.

Due to the PoS transition, proponents were divided. Some decried a switch in ETH’s fundamental ethos, while a group led by Chinese miner Chandler Guo even banded together to maintain a version of Ethereum’s PoW chain.

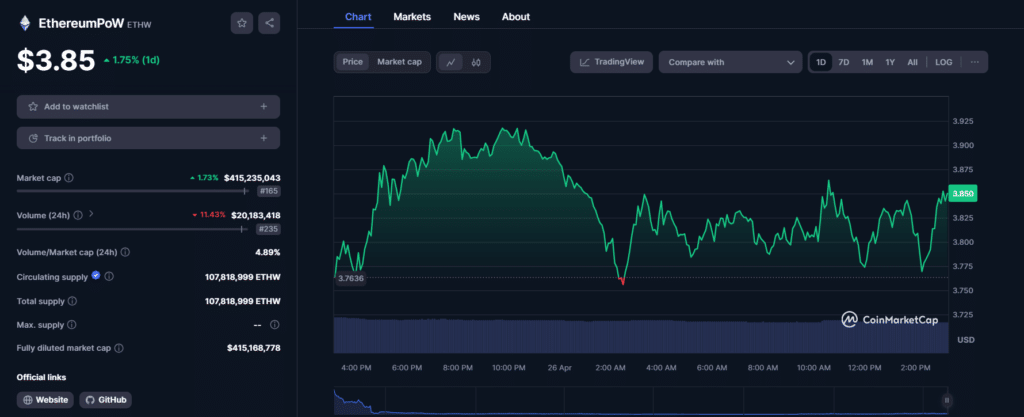

The initiative dissolved its core team to adopt complete autonomy, but the project struggled to gain traction. As of April 26, the ETHW native cryptocurrency changed hands under $4 per CoinMarketCap.

ETHW price chart | Source: CoinMarketCap

ETHW price chart | Source: CoinMarketCap

On the other hand, Ethereum’s main PoS chain has seen skyrocketing validator numbers and staking demand. Crypto.news reported in February that more than 25% of ETH circulating supplied has been locked away to secure the network and earn yield for participants.

Vitalik Buterin has also shared various proposals to decentralize staking further and simplify Ethereum’s PoS model.

7 months ago

36

7 months ago

36