ARTICLE AD

Ethereum Co-Founder Vitalik Buterin spoke at the ETHTaipei 2024 event, which takes place in Taipei from March 21 to 24.

Buterin stated that one of the critical problems with Ethereum’s proof-of-stake (PoS) is the potential centralization. He supported the concept of rainbow staking, initially introduced in February by Barnabe Monneau of the Ethereum Foundation. The proposed mechanism is designed to motivate all categories of service providers, both single and professionals, to participate.

Vitalik continued to discuss the centralization risk of ETH staking on ETH Taipei, emphasizing that LIDO COINBASE BINANCE and others have an excessive share, and introduced the idea about "rainbow staking", a conceptual framework allowing protocol service providers, whether… pic.twitter.com/rfFlcxNzyc

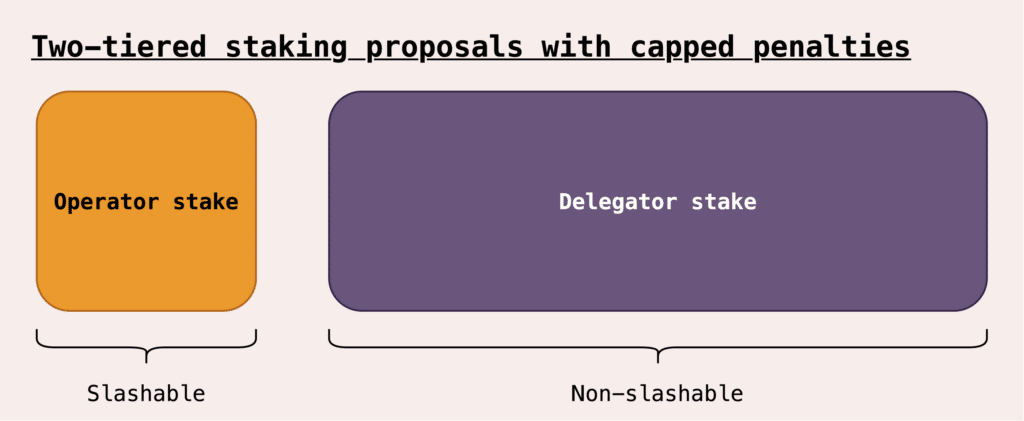

— Wu Blockchain (@WuBlockchain) March 21, 2024One of the main ideas of the developer is to consolidate the existing division into “operators” and “delegators,” as well as the introduction of classes of “heavy” and “light” services with different levels of responsibility and income.

Source: Ethereum Research

Source: Ethereum Research

In his speech, Buterin drew attention to a category he called “lazy stakers”. Its representatives own 32 Ethereum (ETH), the minimum threshold for the validator to operate. Typically, such a group uses pools and liquid staking instruments. The Ethereum founder believes stakeholders could opt for individual staking to reduce centralization risks.

Buterin also noted that users were repeatedly told not to use Lido Finance, while its total value locked (TVL) is now $34.3 billion, being the largest Ethereum validator and controlling more than 30% of assets. Other major providers of liquid staking services include Binance and Coinbase, which are major crypto exchanges.

In October 2023, Buterin proposed staking changes aimed at reducing Ethereum’s centralization. He expressed concern about asset distribution among Ethereum liquid staking providers. At that time, the liquid pool of the Lido Finance platform controlled more than 70% of Ethereum in staking, although the asset is distributed among various validators.

9 months ago

60

9 months ago

60