ARTICLE AD

CoinShares analysts presented a weekly report on the inflows of funds in cryptocurrency funds.

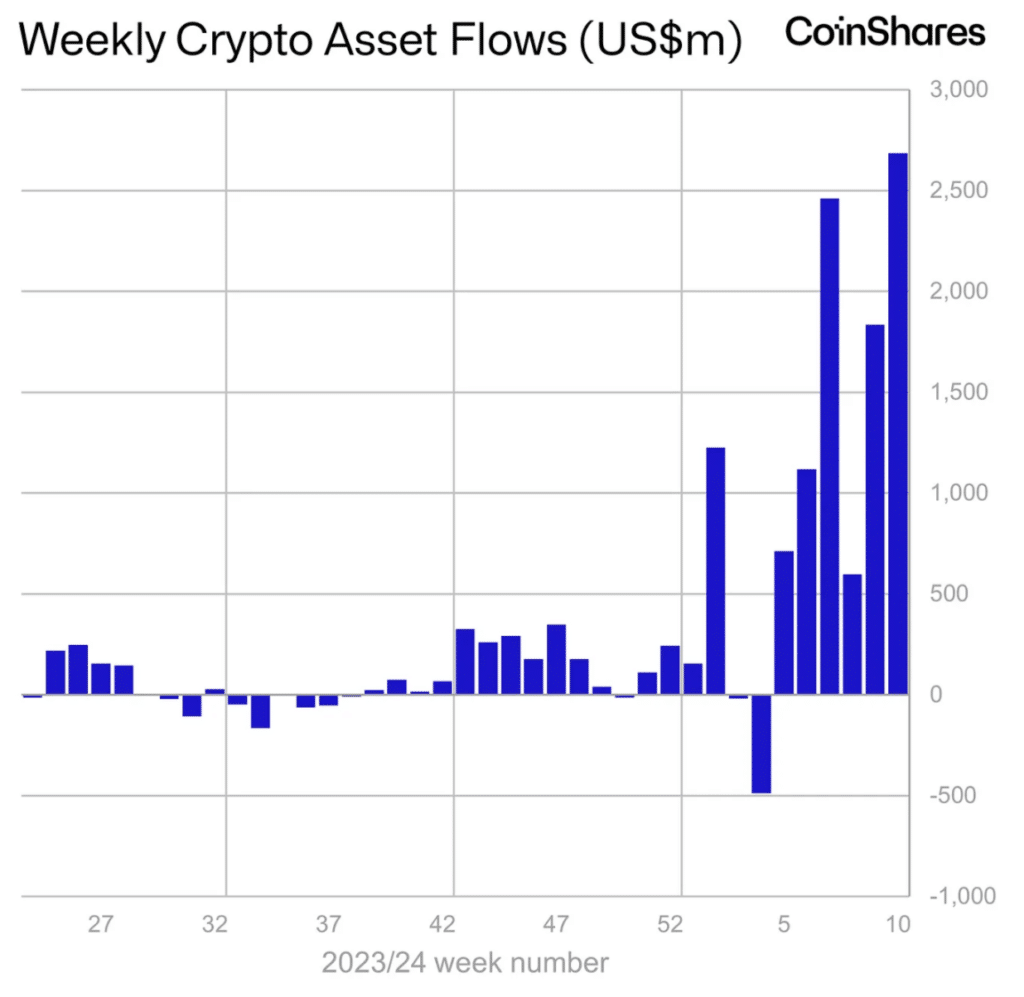

According to the latest report, capital inflows into this category of investment products reached a record level of $2.7 billion between March 2 and March 8, 2024.

Source: CoinShares

Source: CoinShares

The total inflow over the past two months amounted to $10.3 billion. For comparison, experts noted that for 2021, during the bull run, this figure amounted to $10.6 billion.

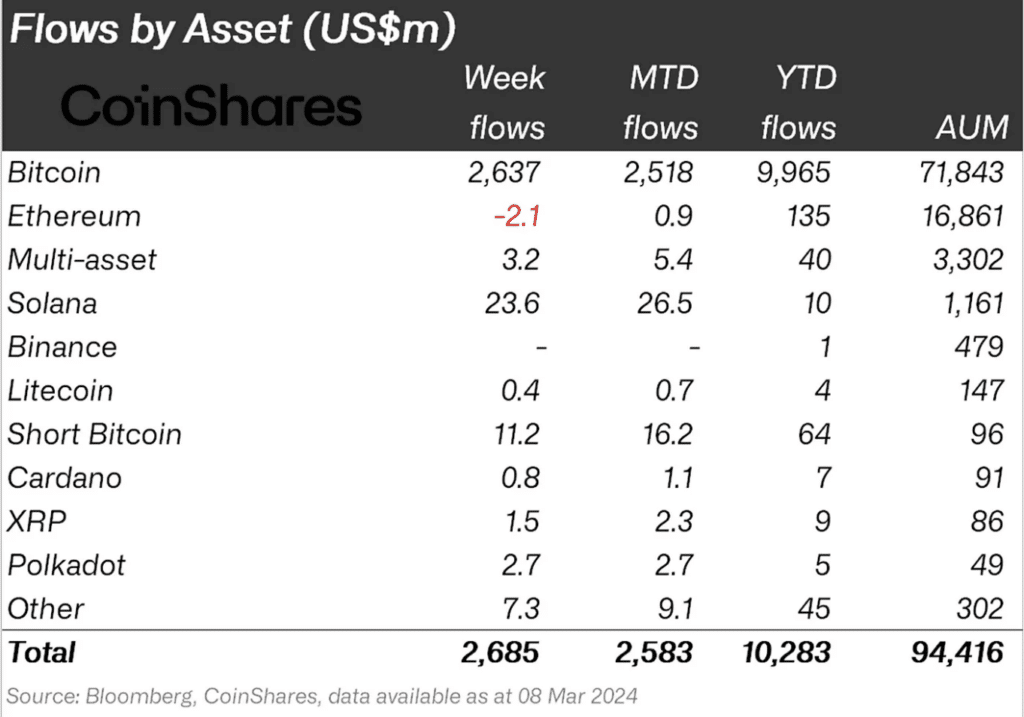

Bitcoin (BTC) played a crucial role in the increase in volume, accounting for $2.6 billion. Analysts note that since the beginning of the year, the asset has demonstrated an influx of 14% of the total volume of crypto assets under management (AUM).

CoinShares representatives also highlighted Ethereum’s (ETH) slight outflow of $2.1 million. At the same time, Solana (SOL), which had previously faced a “bout of negative sentiment,” resumed the influx of funds, reaching $24 million.

Source: CoinShares

Source: CoinShares

At the regional level, the undisputed leader with a plus sign was the United States, with an indicator of $2.8 billion. They were followed by countries such as Switzerland, which had $21 million, and Brazil, which had $18 million. Experts said that profit-taking was observed in Germany, Canada, and Sweden. The total outflow in these countries was $151 million.

The record influx of assets into cryptocurrency funds coincided with BTC updating its all-time high last week. The first cryptocurrency surpassed the $70,000 level on March 8, and on March 11, the price of Bitcoin again reached a record, increasing to $72,000.

As a result, BTC rose to eighth position in the ranking of the most significant assets/counterparties in market capitalization, overtaking silver. According to Companies Market Cap, Bitcoin’s current capitalization is more than $1.4 trillion.

10 months ago

56

10 months ago

56