ARTICLE AD

Key Notes

AAVE's market cap surged by 53% over two weeks, reaching $3.622 billion amid the DeFi bull run.Whale transactions hit a 24-hour high since March 2022, boosting on-chain volumes to $385.9 million.Active unique addresses peaked at 2,346, the highest since June 2023, signaling growing network demand.Total Value Locked (TVL) crossed $35 billion, surpassing the 2021 bull run peak, indicating sustained growth potential.As the DeFi segment picks up pace, reaching the $160 billion market cap, AAVE AAVE $246.7 24h volatility: 5.4% Market cap: $3.70 B Vol. 24h: $1.18 B comes as one of the rising choices for crypto whales. AAVE is a decentralized finance protocol dealing with lending and borrowing services.

With liquidity pools. AAVE provides flash loans in the crypto market. As the altcoin season arrives, the AAVE token is springing back into action.

Whales Boost On-chain Numbers

Over the past 14 days, the market cap of the DeFi protocol has increased by almost 53%. The rising FOMO amid pro-crypto policies of the new Trump administration drives the bull run.

Amid the improving sentiments for the DeFi market, the AAVE token has hit a market cap of $3.622 billion. Over the past 30 days, it has increased by ~90%, with the trading volume getting closer to $1 billion. Currently, the DeFi token is trading at a price of $248, reflecting a minor pullback from the 24-hour of $252.59.

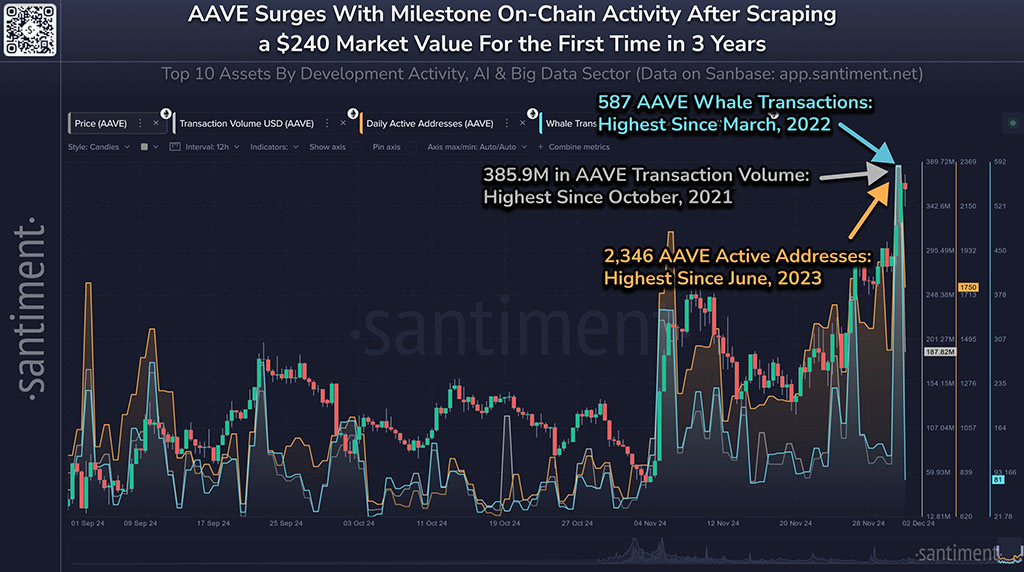

As the numbers grow, the interest of crypto whales in the AAVE token has significantly increased. Over the past 24 hours, 587 whale transactions have occurred, which is the highest since March 2022.

The whale activity has boosted the on-chain transaction volumes to reach $385.9 million. This is the largest on-chain transaction volume recorded since October 2021.

Amid the growing network activity, 2,346 unique addresses were active on the network. This is the biggest number of addresses active since June 2023.

With the growing demand and network activity, the bullish trend in AAVE is likely to scale to a new all-time high. Currently, based on its current all-time high of $670, it is trading at a 63.88% discount. Hence, it shows a massive room for bullish growth.

AAVE Investors Turn Green as TVL Crosses $35B

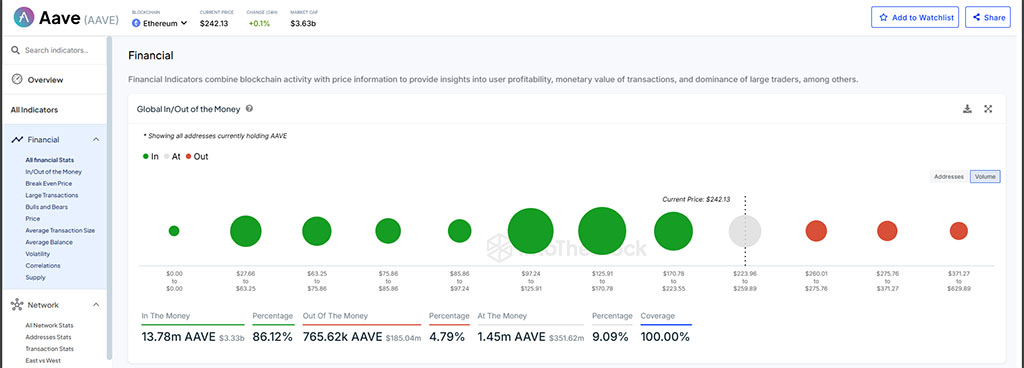

Amid the ongoing rally, the global in-and-out-of-the-money indicator from IntotheBlock gives interesting numbers. With 86.12% of AAVE volume present in the “in the money” zone, profitable investors hold $3.33 billion worth of 13.78 million AAVE tokens.

However, the out-of-the-money segment holds on to the 4.79% volume. This accounts for 765.62K AAVE tokens worth $185.04 million.

The remaining 9.09% of the volume is in the “at-the-money” zone, which extends from $223.96 to $259.89. This zone accounts for 1.45 million AAVE tokens worth $351.62 million.

As the AAVE rally gains momentum, the total value locked over the network has reached a new all-time high of $35.539 billion. This has surpassed the $33 billion peak in the 2021 bull run.

In conclusion, rising whale interest and the growing DeFi segment are the key drivers of the AAVE rally. Furthermore, the crypto-friendly policies of the Trump administration could also fuel the next parabolic rise in AAVE. Hence, the DeFi token could witness a new all-time high formation in early 2025 if the rally continues.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Aave News, Altcoin News, Cryptocurrency News, News

Vishal, a Bachelor of Science graduate, began his journey in the crypto space during the 2021 bull run and has since navigated the subsequent market winter. With a strong technical background, he is dedicated to delivering insightful articles rich in technical details, empowering readers to make well-informed decisions.

10 hours ago

8

10 hours ago

8