ARTICLE AD

Anshu Sharma is a serial entrepreneur and a former venture partner at Storm Ventures.

More posts by this contributor

Clayton Christensen was an amazing observer of business, and his work on disruption is seminal. His book “The Innovator’s Dilemma” has come to define how we analyze companies that get disrupted by newcomers.

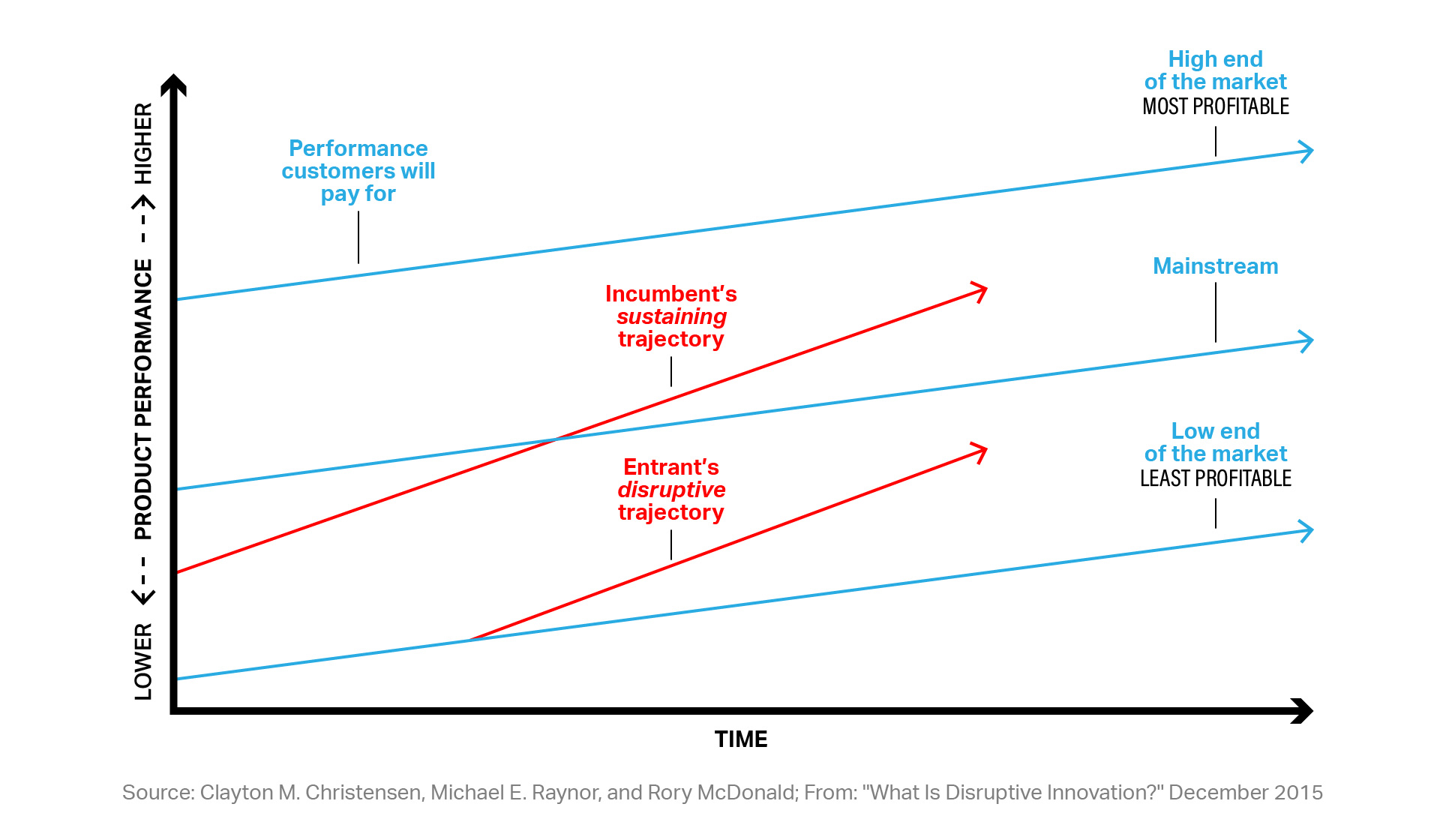

The core of his thesis is that companies focus on their current best customers and improve the product for them while a new entrant comes in with a cheaper product that serves the underserved segment with an inferior product that is good enough — and over time, the inferior product gets better enough to meet the needs of most customers disrupting the incumbent’s core business.

But has he been proven wrong in the last 10 years on many major disruptions? For instance:

iPhone was more expensive than competitors at launch. Tesla was more expensive than most cars for early models, by a lot. Nvidia GPUs are way more expensive than Intel and ARM machines. OpenAI or GPT4 is not cheap. While search engines are free for unlimited use, GPT is $20 month.What if the bottom-up cheaper product disrupting the market is a phenomenon limited to commoditized old product categories (think tires and clothes)? Although, one could argue even in those categories the real disruption often starts at the highest end — run flat tires cost more, yoga pants (Lululemon and Alo Yoga) cost more — not less than the older products they replace in use.

The Christensen theory of disruption could be called “inferior disruption theory” — inferior, cheaper, good enough products that disrupt incumbents over time. While this clearly happens, there’s a more powerful model for disruption.

Image Credits: Clayton M. Christensen, Michael E. Raynor, and Rory McDonald

In his own words:

1 year ago

43

1 year ago

43