ARTICLE AD

The global cryptocurrency market cap has lost $40 billion over the past 24 hours amid the sustained market-wide turbulence that has seen several assets such as Bitcoin (BTC) and Ethereum (ETH) drop by shocking margins.

This downtrend, which started on Jan. 12 following the initial hype surrounding the spot Bitcoin ETF approval, has endured amid several selloffs from institutional and retail investors alike. It has led to a slew of selloffs that has compounded into panic across the market.

Bitcoin triggers market-wide bloodbath

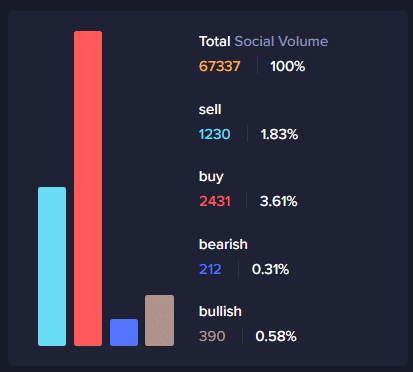

As a result, market sentiment has dipped significantly, per data from Santiment. Santiment’s total social volume metric suggests that, while social activity has increased over the past week, the crypto community has focused primarily on buy and sell mentions.

Social trends data – Jan. 23 | Source: Santiment

Social trends data – Jan. 23 | Source: Santiment

However, despite the downtrend, market participants are leaning toward “buy the dip” tendencies, as “buy” mentions increase to 2,431, taking 3.61% of the total social volume. In addition, mentions of “sell” have risen to 1,230, accounting for 1.83% of social volume.

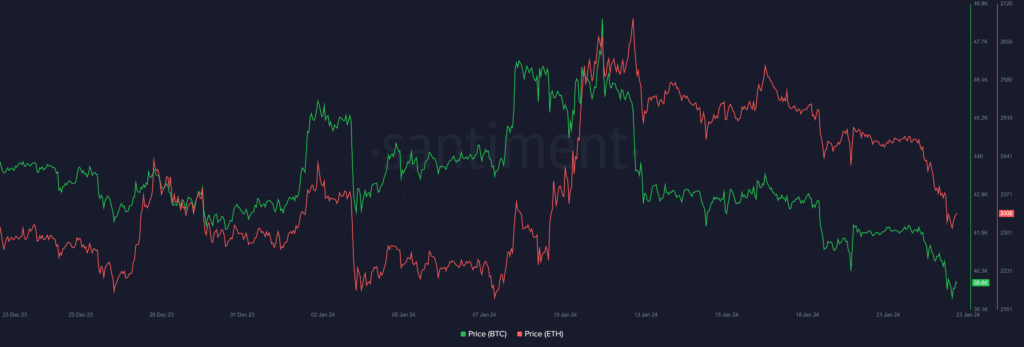

The market faced a considerable setback yesterday following Bitcoin’s collapse below the pivotal $40,000 support threshold. The asset had defended the $40,000 level since the start of the year until Jan. 22, when it slumped to $39,700.

Bitcoin recovered the $40,000 support almost immediately. Nonetheless, a resurgence of bearish pressure has triggered a similar market drop, with the asset currently changing hands at $39,734. BTC declined by 3.7% over the last 24 hours.

BTC and ETH price – Jan. 23 | Source: Santiment

BTC and ETH price – Jan. 23 | Source: Santiment

The BTC dip has affected the rest of the market, with ETH dropping by 4.11% in the past 24 hours to $2,307 at the reporting time. ETH recorded a massive 5.11% intraday loss yesterday, as the bears target the $2,300 support in an attempt to trigger further declines.

The GBTC selloffs

This market bloodbath has been exacerbated by massive selloffs from the Grayscale Bitcoin Trust (GBTC) shortly after the ETF approval. Interestingly, after the SEC’s ETF approval, Alameda, FTX’s sister firm, recently withdrew its case against Grayscale.

However, data suggests that FTX also sold off 22 million GBTC shares, compounding the bearish pressure on Bitcoin and the broader market. Besides the FTX sale, institutional investors have continued to dump their GBTC shares, resulting in more BTC selloffs.

Grayscale recently moved $1.3 billion to Coinbase, the custody service provider for GBTC. Amid an outflow of $2 billion from the ETF, a market analyst pointed out that the product’s 1.5% high fee and the absence of its massive discount have triggered the investor exodus.

Meanwhile, as the onslaught endures, CryptoQuant data confirms that exchange net flows recently pivoted to bullish grounds, with deposits on exchanges currently lower than the weekly average. This pattern entails that the selloff campaign might be slowing down.

1 year ago

71

1 year ago

71