ARTICLE AD

The global cryptocurrency market has notably declined as Bitcoin (BTC) dipped close to the $66,000 mark.

According to data provided by CoinGecko, the global crypto market capitalization plunged by 4.6% in the past 24 hours and is sitting at $2.63 trillion at the time of writing. The daily trading volume, however, increased by 42%, reaching $134.77 billion, per CoinGecko.

The marketwide decline comes as the leading cryptocurrency, Bitcoin, dropped from $70,000 to $66,400 over the past 24 hours. The BTC market cap is currently hovering around the $1.3 trillion mark with a 24-hour trading volume of $40 billion.

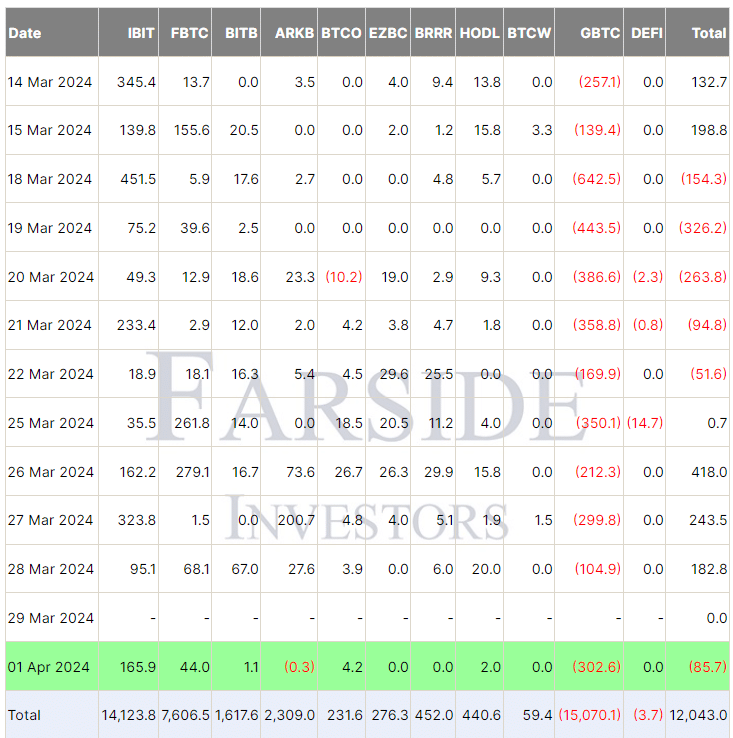

Moreover, Bitcoin ETFs recorded a total net outflow of $85.7 million on April 1, according to data from Farside Investors. Data shows these investment products reached a total of $862 million in inflows last week.

BTC ETF net flows – April 2 | Source: Farside Investors

BTC ETF net flows – April 2 | Source: Farside Investors

On March 31, Tether, the company behind the largest stablecoin, purchased 8,888 Bitcoins for $618 million — the average price of each coin is $69,531. The firm currently holds over 75,000 BTC at an average price of $30,305.

Buy the dip?

Some investors and social media users are discussing the possibility of whale manipulations and even buying the “dip.”

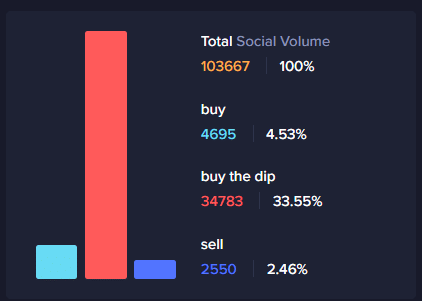

Social volume for “buy,” “buy the dip,” and “sell” – April 2 | Source: Santiment

Social volume for “buy,” “buy the dip,” and “sell” – April 2 | Source: Santiment

According to data provided by Santiment, calls for “buy the dip” have skyrocketed over the past 24 hours — dominating 33.55% of the total social volume around crypto-related topics.

The majority of the social media conversations discussing the potential buying opportunity come from Reddit and 4chan, per Santiment.

Data shows that social media conversations discussing another selloff dominate only 2.46% of the total conversations and posts.

7 months ago

40

7 months ago

40