ARTICLE AD

Igor Shaverskyi Contributor

A finance nerd with a decade of experience across various industries, Igor Shaverskyi is a partner at Waveup, where he helps startups fulfill their growth potential.

In 2023, associates and partners at Waveup reviewed over 300 pitch decks, from pre-seed to Series C. In every other deck we’ve examined, one of the most crucial slides — the go-to-market (GTM) — has been mishandled or skipped altogether. As you might guess, these decks don’t get funded quickly.

Your GTM motion is imperative for investors, especially during the early stages. From pre-seed to later stages, investors strongly care about three things:

The quality of your founder/team. The size of your market/opportunity. The effectiveness of your execution strategy.The last one is heavily dependent on an innovative, believable go-to-market approach. Here, investors want evidence that you know how to launch your product and boost your growth fast, ideally with minimal investments. Long gone are the times of “growth at all costs” and “spray and pray” marketing tactics.

In 2024, VCs will seek a concrete operational plan and strong evidence of competitive moats in your GTM approach. It’s going to be a year of no BS.

Stop treating your go-to-market plan as a marketing strategy

Your go-to-market ≠ marketing strategy. To some, that might sound like an obvious statement. To the majority, however, it’s not as clear. The number of founders using their GTM slide to describe a marketing strategy is downright problematic.

Your GTM is about much more than marketing. It’s an overarching approach that should cover elements such as the target market segment (i.e., ideal customer profiles) and the acquisition and distribution strategies you’ll employ to launch and promote your offering. These elements must be evident in the GTM section of your pitch deck, with the degree of detail and comprehensiveness tailored to your particular stage.

Unfortunately, GTM slides filled with generic digital marketing channels and activities like SEO (search engine optimization) or SMM (social media marketing) — without any explanation of what leverage they provide in this case—are a standard story. Below is a slide from our D2C client that clearly illustrates what NOT to do with your GTM slide.

Image Credits: Waveup

What’s wrong with this example:

Too generic: Lists channels and activities that virtually everyone uses — include them in any deck, and they’ll fit. Misses the moat: Doesn’t demonstrate the strategy’s competitive edge or uniqueness. Scattered focus: The presentation is disjointed and lacks strategic focus.How to improve it

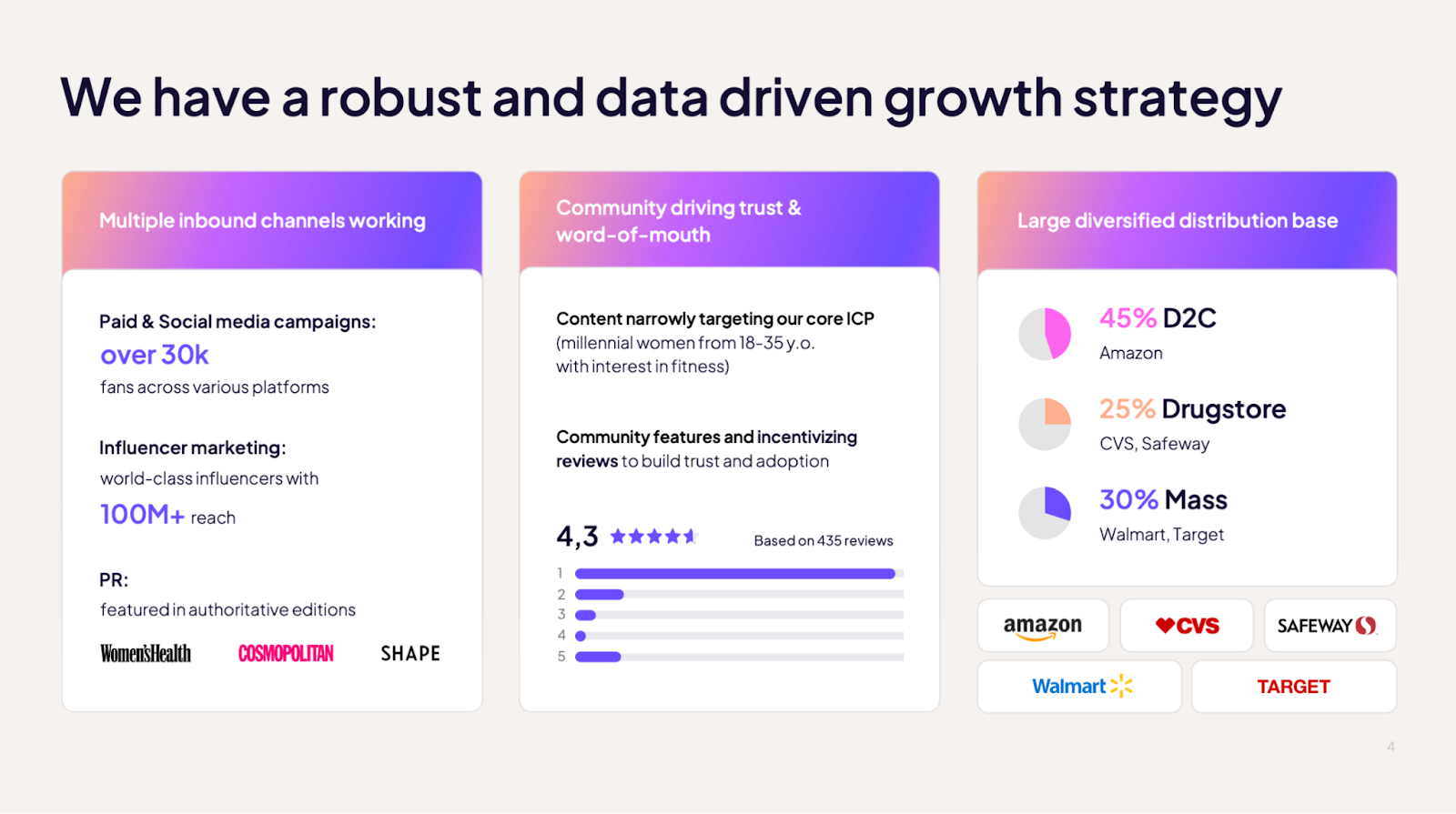

An example of how you can rework the slide to widen the focus from marketing only to the overall GTM approach:

Image Credits: Waveup

Talk about your ideal customer persona (ICP) now and in 6, 18, 24 months

Even if you’re selling towels and your target market is “everyone who showers,” you can’t start by marketing to every person in every location. In 99 out of 100 cases, you’ll begin by zeroing in on a specific market segment, customizing your product and approach to appeal to your ICP representing that segment.

This initial concentration on a single market segment is vital. Once you’ve conquered it, you can move upmarket or broaden your geography, adapting your product and acquisition strategies. This approach is known as a beachhead market strategy, which is what investors seek in your GTM plan.

Unfortunately, many startups jump into pitching without having a coherent initial ICP and focus. Or they think they have one, but their presentation tells a different story.

I’ve seen many early startups with a “multifaceted” GTM strategy attempting to target multiple geographies with different products through various channels. In the pitch deck, this looks like a hodgepodge with no specificity of who you will target, how, and when.

Image Credits: Waveup

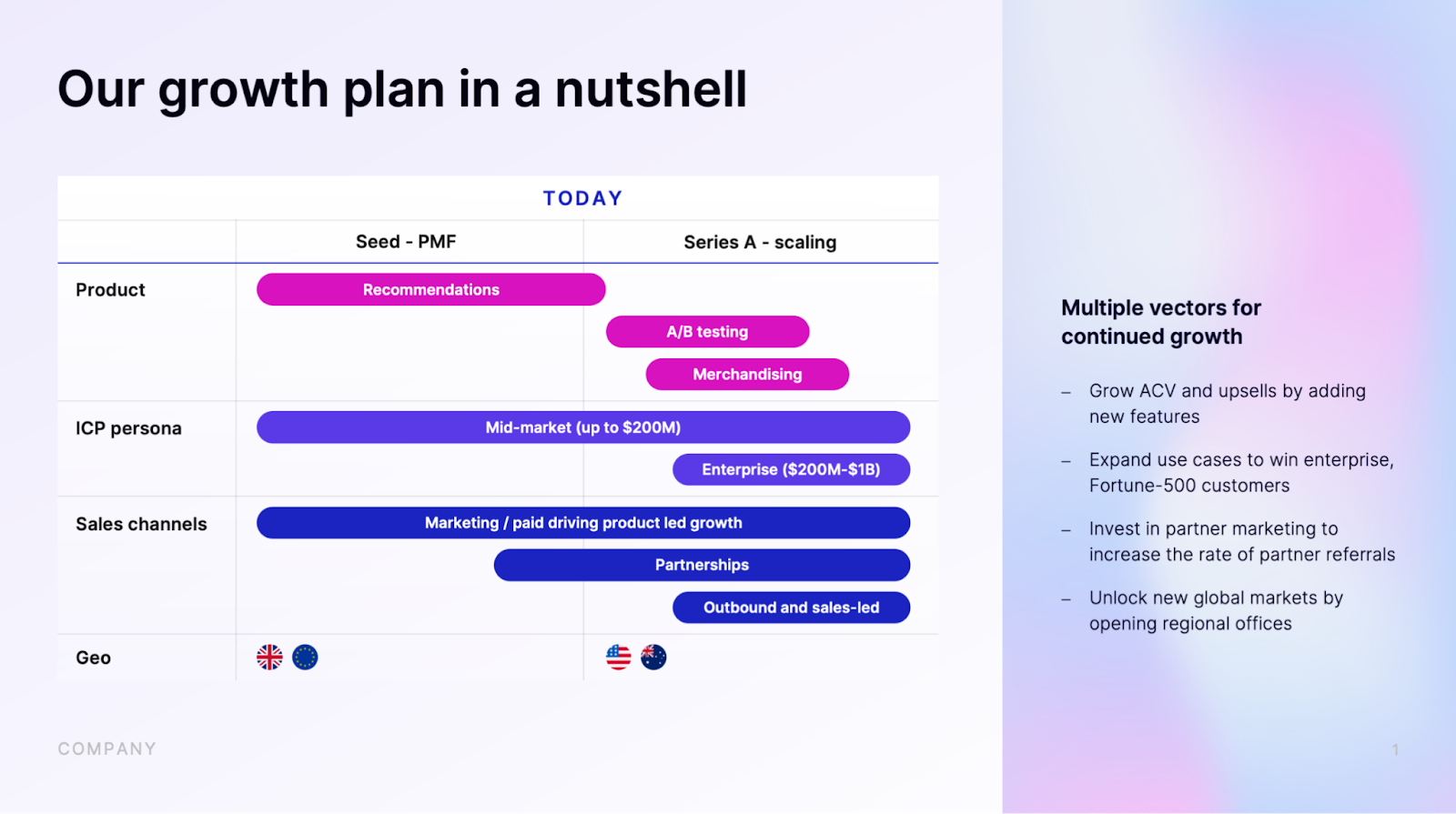

Your go-to-market slide is supposed to persuade investors that you have a solid operating plan for the next 18+ months on winning the market and outsmarting the competition, supported with actionable, concrete milestones and, ideally, early evidence of why this strategy will work.

A good start is walking investors through your market vision and logic. Address the critical questions: Who are your customers? What’s your GTM motion? What channels do you use — online/offline acquisition, inbound/outbound? Why did you choose those channels?

Remember: Your strategy is dynamic and should evolve with your ICP as you pursue more significant markets. Show investors you understand how to do that and show them the timeline.

An example below can be the inspiration, but you can take it one step further and turn it into a proper operational plan that also breaks down expected milestones (number of users, partners, revenue, etc.) per each stage to prove indisputably to investors that you have a solid execution plan going forward.

Image Credits: Waveup

Be very intentional with your go-to-market motion

Regarding SaaS startups, specifying your growth motion — why you’re choosing it and what it will be — is paramount at any stage. Your motion type depends on your market, product, and competitive moat. And here’s where this connects to the previous point: You can’t figure out the proper GTM motion for your product without understanding your ideal customer’s needs.

The most typical go-to-market motions are product- or sales-led (with the recently everyday new kid on the block — community-led growth). Yet, founders often “go hybrid” by bundling together various growth motions when their product and audience don’t call for it (yet). A typical statement might be, “We will pursue a product-led motion supplemented with an enterprise-led motion,” all without shedding any light on why this combination would be effective in their case.

Such an approach is all right per se. Employing different motions might be warranted when you have already solidified your initial persona with an existing product and are now poised to expand your market and tailor your product accordingly.

Just ensure you do this in a timely manner because adding a sales-led motion to sell a reasonably simple, SMB-prised solution with an average contract value under $4,000 will sink your unit economics and chances to raise capital.

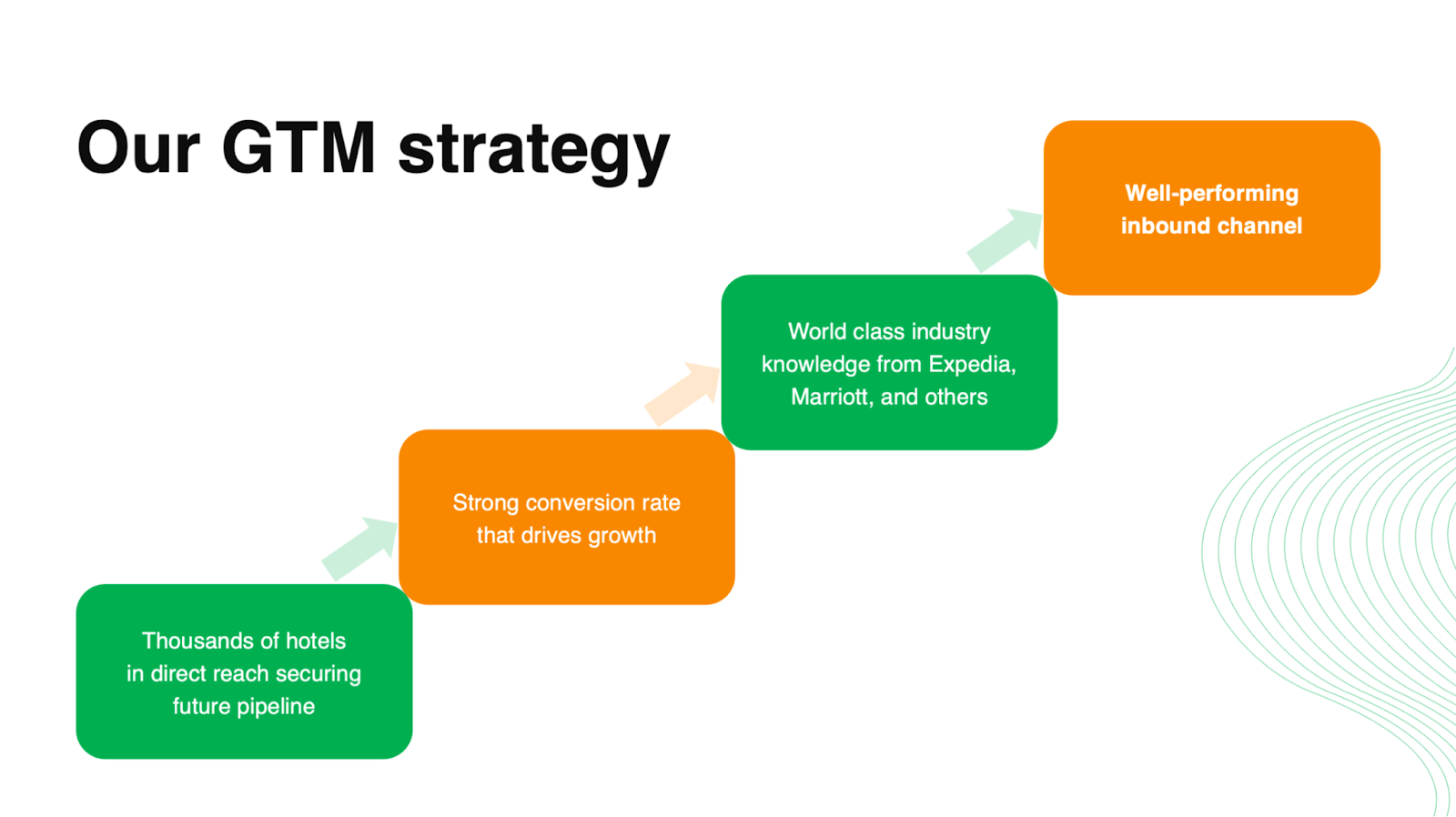

Do think about the competitive moat in your GTM plan

The No. 1 mistake from all the decks we see is generic go-to-market strategies similar to the rest of the market. You can only persuade investors that you will execute better if you have an underlying advantage in your GTM approach.

Image Credits: Waveup

The fix is easy. Think about your assets or moats that will allow you to scale faster or cheaper. Demonstrate how the strategy chosen links to your experience and prove how it will give you an edge over your competition.

For instance:

An established network of partners that drastically reduces time to market. Strong community presence and large/quickly growing social media following with XXX followers that helps to build critical user mass instantly. Broad content base (X articles) that drives massive organic traffic. Integrations with other products or partners (name them). Established connections with topical media outlets (name the media). Community around the brand powering referral flywheel and resulting in CAC (customer acquisition cost) that is 3x lower than the industry average.These facets give you a shortcut to customers, and that’s what investors will be sold on.

For example, here’s how we reworked the slide above to drive more interest from investors:

Image Credits: Waveup

Show, don’t tell — use numbers to support your claims

The slide above is an excellent example of how the numbers can completely change the narrative and perception of your strategy. Too often, we see GTM slides that are simply boring — not to mention completely unconvincing.

Image Credits: Waveup

This is lazy and unconvincing; avoid falling into this trap. Whenever you’re trying to drive a point home, nothing does it better than numbers that reflect real traction.

Chances are, by the time you pitch to investors, you’ve gained a glimmer of traction in the market. If that’s the case, don’t just say it — show metrics that bolster your statements.

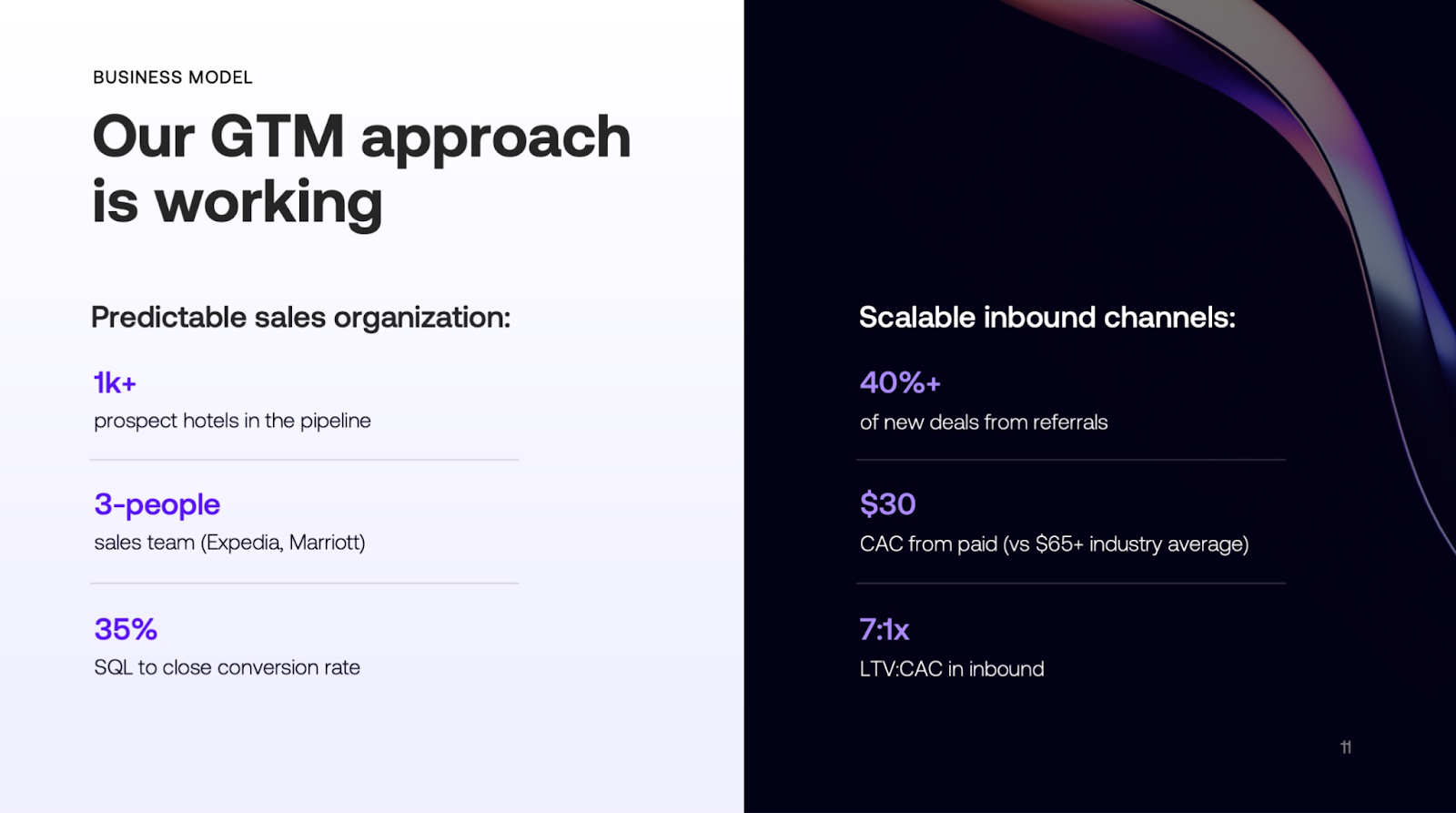

LTV: CAC, payback time, conversions, organic referrals growth: If these metrics stand firm against industry benchmarks, pull them up. A great way to draw investors’ attention is to open your slide boldly with the statement, “Our strategy is working,” and follow up with the metrics that signal growth.

If you still need to start operating at full throttle and only some channels produce results, hone in on those performances.

For example:

Our partnership channel yields a 10:1 LTV to CAC ratio. Our strategic partners bring us clients at a 60% conversion rate. Organic referrals generate 40% of our new business.Here is how we did that for a travel payment platform:

Image Credits: Waveup

Dive into your current KPIs to unearth traction signals demonstrating that your strategy makes sense. Find the proof points that will de-risk the investment for the funders. It will always take extra work, but doing so will also earn you extra points for understanding and tracking the key metrics.

Remember, your go-to-market strategy isn’t just a marketing footnote in your pitch deck; it’s the crux of your growth plan. Don’t miss the mark.

1 year ago

85

1 year ago

85