ARTICLE AD

Samson Mow, a developer and founder of a crypto project, has attributed the current Bitcoin price stability to the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States. Taking to X on February 22, Mow argued that these spot ETFs have prevented a significant price drop.

Bitcoin Remains Higher Because Of Spot ETFs

The founder believes that without the influx of capital from spot Bitcoin ETFs, the cryptocurrency would have been “down between 10-20%,” potentially placing it below $40,000. So far, and when writing in mid-February, the various derivatives have injected billions of dollars into the Bitcoin market. Subsequently, the asset’s liquidity has increased.

Related Reading: FTX’s Sam Bankman-Fried Is Back In Court: Here’s Everything You Should Know

The relationship between liquidity and volatility is complex but being established, especially in the crypto and Bitcoin markets. However, the rule of thumb is that the more there are buyers and sellers, that is, traders, the higher there is circulating capital, increasing liquidity. Liquidity, in simple terms, is a measure of how easy it is to trade.

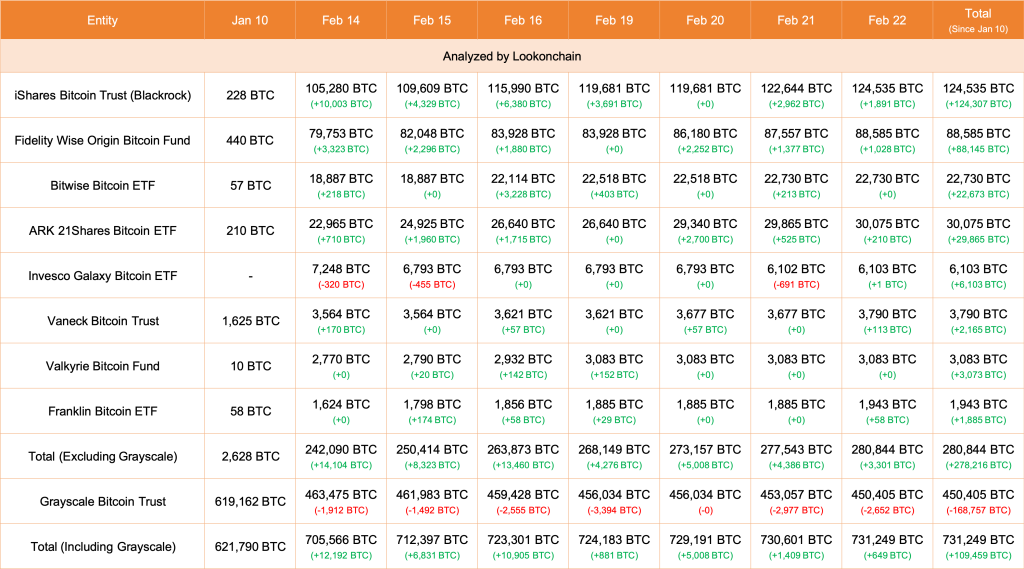

In an illiquid market, circulating capital is relatively lower, meaning it can be hard to swap assets. Since the launch of spot Bitcoin ETFs, billions of dollars have been funneled to the market, according to Lookonchain data. As of February 18, BlackRock bought over $96 million worth of BTC through its ETF product.

Institutions buying BTC | Source: Lookonchain data on X

Institutions buying BTC | Source: Lookonchain data on X

As such, the consensus is that Bitcoin is now more liquid, which Mow agrees with. So far, CoinMarketCap data shows that Bitcoin commands over 50% of the total market cap. The value of all circulating coins, including irrecoverable ones, stands at over $1 trillion.

That Bitcoin, as Mow highlights, is now more stable can help attract more investors. Usually, institutional-grade investors seek stability, a characteristic that Bitcoin now exhibits. However, rising liquidity will mean Bitcoin is less volatile, making the asset less attractive for speculators.

Price Finds Support At $50,500: Will It Hold?

The Bitcoin price daily chart shows that the coin remains within a tight range but is bullish. After the brief retest of $53,000, the coin cooled off to spot rates but found support at around $50,500.

If the uptrend is valid, the coin will likely reject attempts for lower lows and break above $53,000. Subsequently, this might anchor the leg up towards $70,000. Analysts are also looking at the upcoming Bitcoin halving as a possible accelerant.

Even so, whether this will be the case remains to be seen. Bitcoin, despite its increasing liquidity, is still a new asset class. The global market is still adapting, and more institutions will likely adopt the asset as they diversify their portfolios.

Feature image from Canva, chart from TradingView

9 months ago

48

9 months ago

48