ARTICLE AD

Worldcoin’s 200% surge in the last week looks likely to buffer crypto creditor payments for investors in Three Arrows Capital and FTX, although a token unlock may induce sell pressure.

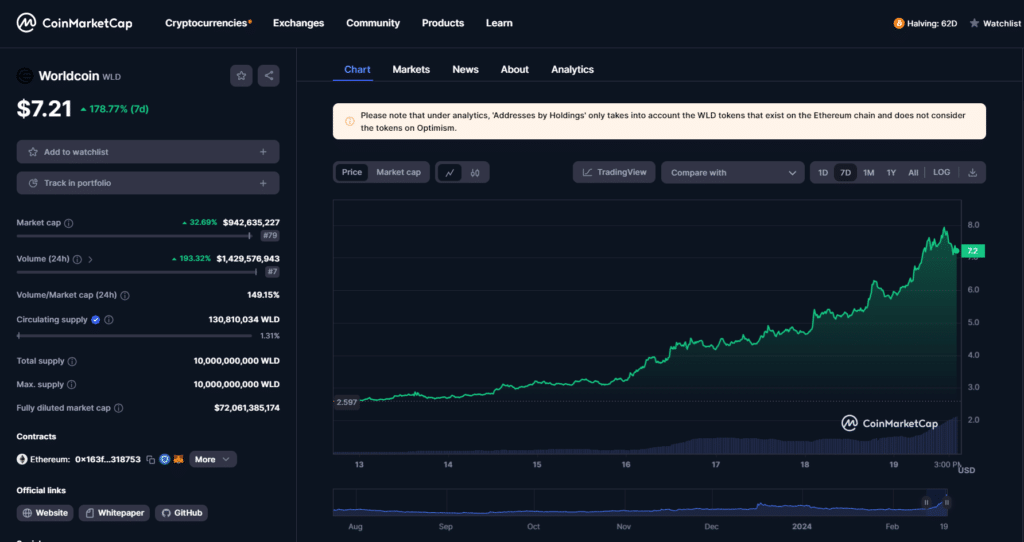

Worldcoin’s native token WLD achieved an all-time high on Feb. 19, rising to $7.40 per coin following the launch of an artificial intelligence solution created by Sam Altman’s OpenAI. Altman holds high-ranking positions at both Worldcoin and OpenAI, the company behind the text-to-video tool Sora.

As crypto.news reported, WLD saw price upticks after Sora’s launch, though both products are unrelated.

WLD hits all-time high | Source: CoinMarketCap

WLD hits all-time high | Source: CoinMarketCap

Worldcoin investors in green

Two bankrupt crypto entities received millions of WLD tokens for being early investors. Three Arrows Capital (3AC) featured in a $25 million funding round for Tools For Humanity, a company co-founded by Altman. Tools For Humanity created the digital identification project Worldcoin.

According to Arkham Intelligence, 3AC liquidator Teneo holds 75 million WLD tokens valued at over $550 million with the latest price movement. 3AC or Teneo may hold more WLD tokens on unidentified wallets. The defunct crypto hedge fund and its founders, Su Zhu and Kyle Davies, owe $1.5 billion to creditors.

Zhu said in an X post that 3AC boasts one of the biggest known WLD positions.

Got hated on a lot for this worldcoin investment in 2021. i remember the hit pieces on it were so bad most of the seed rd refused to tweet to support it

I wont be benefiting from WLD outperformance but i'm glad 3ac creditors have one of the largest positions in WLD in the world https://t.co/maCxk5otWr

FTX, a crypto exchange founded by the convicted Sam Bankman-Fried, also reportedly invested in the eyeball-scanning initiative and received WLD for its early support. Wallets affiliated with Bankman-Fried received $185 million in WLD tokens. The coins airdropped in August last year when Worldcoin launched, were distributed across multiple wallets, per SpotOnChain data.

Investors may experience reduced gains on bankruptcy holdings due to WLD sell-off in the open market. Per Token Unlocks, $165 million worth of WLD tokens will enter circulation up until Feb. 26.

While WLD’s price ascends, the project was initially met with scrutiny when it launched. Governments in Kenya and France in particular investigated Altman’s protocol over private data security concerns.

However, Worldcoin is expanding in other regions like Argentina, Singapore, and Chile, where over 200,000 Chileans have scanned their eyes with the project’s Orb devices.

1 year ago

63

1 year ago

63