ARTICLE AD

Cryptocurrency analysts are abuzz with chatter surrounding NEAR Protocol (NEAR) as the token experiences a meteoric rise in value. The past month has been nothing short of phenomenal for NEAR, with its price leaping by an impressive 130%.

Will NEAR Hit $8?

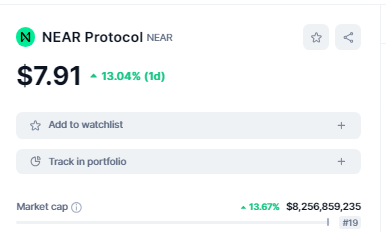

This surge, which translates to an impressive $7.91 per token at the time of writing, has not gone unnoticed, igniting a firestorm of interest and speculation within the investment community. But is this a genuine upswing or simply a fleeting fad?

Source: CoinMarketCap

Source: CoinMarketCap

Breaking A Downtrend Or Chasing A Fad?

While some analysts, like the prominent Rekt Capital, view this surge as a potential reversal of a multi-year downtrend, others urge caution. The cryptocurrency market, after all, is notorious for its wild fluctuations. A token’s price can reach dizzying heights only to come crashing down just as quickly.

Finally – Near Protocol has revisited its multi-year Macro Downtrend

Now #NEAR will try to break this to further build on its current bullish momentum

Breaking this Macro Downtrend would likely see price revisit the old All Time High resistance area

#BTC #NEARprotocol… https://t.co/VmcLjkWFPn pic.twitter.com/wboVljOJsc

— Rekt Capital (@rektcapital) March 11, 2024

Forecast: Bullish With A Side Of Caution

Analysts have forecasted a bullish trend for NEAR in the immediate future. Their prediction suggests a 10% increase, placing the price at around $7.48 by March 13, 2024.

This projected increase comes with a market capitalization of $7.65 billion and a notable 24-hour trading volume of $2.2 billion. However, forecasts, as some experts point out, should be viewed with a critical eye. The market is an intricate web of factors, and unforeseen events can easily derail even the most meticulously crafted predictions.

Technical Indicators, Market Sentiment

Technical indicators, while offering valuable insights, should not be the sole basis for investment decisions. The Fear and Greed Index, currently hovering at an “extreme greed” of 82 for NEAR, paints a picture of a market potentially fueled by euphoria rather than sound judgment.

Investors piling in solely based on such sentiment, with NEAR having already surged 8.06% in the last 24 hours, might be setting themselves up for disappointment if a correction were to occur.

Beyond The Hype: Examining NEAR’s Potential

However, dismissing NEAR’s potential entirely would be unwise. To understand this, we need to examine thoroughly. NEAR Protocol is a blockchain platform designed to address scalability issues that have plagued older blockchain technologies like Ethereum.

NEAR boasts features like sharding, a method for distributing processing power across a network of computers, to facilitate faster transaction speeds and lower fees.

This focus on scalability has attracted the attention of developers seeking to build decentralized applications (dApps) on a platform that can handle high volumes of traffic. Several promising dApps are already being built on NEAR, including DeFi (decentralized finance) protocols and NFT (non-fungible token) marketplaces.

A thriving ecosystem of dApps could be a key driver of long-term growth for NEAR. Crypto experts, drawing insights from the price fluctuations observed at the onset of 2023, have formulated an average projected NEAR rate of $10.06 for March 2024.

While this average is a benchmark, fluctuations within the market suggest potential variations, with the minimum expected price hovering around $9.8 and the maximum reaching $10.2. Considering these forecasts, investors may be enticed by the potential return on investment (ROI) of 35%, indicative of the promising growth prospects for Near Protocol in the coming months.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

8 months ago

45

8 months ago

45