ARTICLE AD

The adoption of open banking and instant payments is moving slowly in the United States compared to other markets around the world, for example, Brazil. That said, the new program FedNow went live in July 2023, and data-sharing regulations are forthcoming, so more potential is on the horizon.

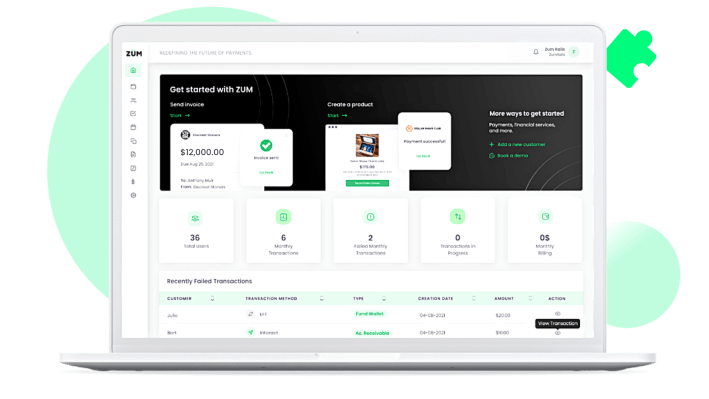

Until then, the co-founders of Zūm Rails say the experiences consumers have with payments continues to be fragmented, meaning companies have to create a tech stack to provide a wide range of services to their customers. The Montreal-based company is taking the approach of providing an all-in-one payments gateway that merges open banking with instant payments.

Marc Milewski and Miles Schwartz started the company in 2019. Milewski’s background is in treasury payments and he was an early employee at accounts receivable automation software company Versapay. While there, he worked on what ultimately became Canada’s first webhook-enabled EFT gateway.

“You learn about all the problems everyone has moving money,” Milewski told TechCrunch. “Open banking was discussed, but I thought it was more about payments. Miles and I talked about building a whole new gateway that unified these experiences. Companies don’t want to be payment experts — that’s our job.”

They started building software to simplify the complexity of moving money via different payment rails so companies can use whichever approach makes sense for their business. Their technology leverages “omni rails” for payments, whether it is traditional credit, debit or electronic funds transfer options. It also provides for real-time options through partners, including Visa Direct, Mastercard, MX and Canada’s Interac network.

Zūm Rails manages the flow of money, including the reduction of fraud and failed transactions, by verifying a customer’s identity, linking directly with bank accounts and facilitating payments via the method of the customer’s choosing.

The company now processes more than $1 billion in payments through its platform each month for over 500 companies, including Questrade, Coinsquare and Desjardins, which is a large federation of credit unions in North America. In the past year, the company grew over 200% and launched in the U.S. at the end of 2023.

Milewski and Schwartz bootstrapped Zūm Rails, building it up to a team of 30 people. Last year, the pair decided to raise venture capital.

“We reached the point where we realize that bootstrapping is no longer healthy for our business,” Schwartz told TechCrunch. “We have some big initiatives we want to work on and grow on. Now it makes sense to do it all at once, and it’s healthy for the business to now go all-in and use the fuel.”

Zūm Rails’ technology leverages “omni rails” for payments, whether it is traditional credit, debit or electronic funds transfer options. Image Credits: Zūm Rails

They closed on a $10.5 million Series A funding round, led by Arthur Ventures, and intend to invest in growing in the U.S. and expanding its payments offerings that will include the introduction of new banking-as-a-service features for merchants. In addition, Zūm Rails is working on a FedNow offering in the U.S. that will enable businesses to send and receive FDIC-insured payments within seconds.

Zūm Rails’ performance to date “is really impressive,” Jake Olson, vice president at Arthur Ventures, told TechCrunch. He called the company “a great fit” for its investment thesis, which is high-growth and capital-efficient B2B software companies.

“Achieving profitability without any outside capital is impressive,” Olson said. “Their product positioning is also really compelling. Rather than weaving together different systems, Zūm Rails can provide organizations with a comprehensive solution that powers the entire transaction journey and enables them to have a seamless experience for their end users. Any organization that views the streamline digital financial interaction coupled with the instant payments capability as a competitive advantage will be a great fit for Zūm Rails.”

1 year ago

59

1 year ago

59