ARTICLE AD

Bitcoin dominated the inflows, and Solana showed a positive result for the week, contrasting Ethereum and Avalanche.

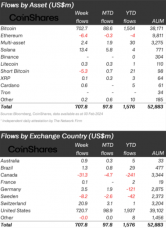

Crypto investment products experienced $708 million in inflows last week, amounting to $1.6 billion in inflows year-to-date, according to a Feb. 5 report by asset management firm CoinShares. Bitcoin (BTC) remains the predominant recipient of investment flows, securing $703 million last week, which accounts for 99% of the total inflows.

In contrast, short-bitcoin products experienced slight outflows of $5.3 million, aligning with a positive shift in price dynamics, while other digital assets showed mixed results. Solana reported inflows of $13 million, overshadowing Ethereum and Avalanche, which faced outflows of $6.4 million and $1.3 million, respectively.

Crypto funds netflows by crypto asset and country. Image: CoinShares

Crypto funds netflows by crypto asset and country. Image: CoinSharesMoreover, total global assets under management have reached $53 billion. Despite declining trading volumes for Exchange-Traded Products (ETPs) to $8.2 billion from the previous week’s $10.6 billion, the figures substantially exceed the 2023 weekly average of $1.5 billion, representing 29% of Bitcoin’s total trading on reputable exchanges.

The United States continues to be at the forefront of these inflows, with a significant $721 million recorded last week. Newly issued Exchange-Traded Funds (ETFs) in the US have been particularly successful, drawing $1.7 billion in inflows, averaging $1.9 billion over the past four weeks, and totaling $7.7 billion in inflows since their launch on Jan. 11.

However, there has been a net outflow from established issuers amounting to $6 billion, though recent data indicates a slowing in these outflows.

In the sector of blockchain equities, a notable outflow of $147 million was observed from a single issuer, yet this was partially offset by $11 million in inflows from other issuers, indicating a diverse investment landscape within the digital asset market.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

1 year ago

64

1 year ago

64