ARTICLE AD

The latest US inflation data significantly impacted the Bitcoin price and most of the cryptocurrency market, with some exceptions. According to a report from the Labor Department, inflation rose more than expected in January, driven by higher shelter prices.

Furthermore, the consumer price index (CPI), which measures the prices consumers face for goods and services across the economy, saw a 0.3% increase for the month. On a 12-month basis, the CPI stood at 3.1%, slightly lower than December’s 3.4%.

Bitcoin Price Retreats Amid Higher-Than-Expected CPI Figures

According to recent reports, the higher-than-expected CPI figures could pose challenges for the Federal Reserve (Fed), as officials anticipate inflation to recede and reach their 2% annual target. The central bank aims to adjust monetary policy, which has been tight over two decades.

However, the January increase in inflation may delay the Fed’s plans to ease rates, as it will require more data before initiating a rate-cutting cycle. This outcome disappointed those who expected inflation to decrease and prompted a reassessment of the timing for potential rate adjustments.

On this matter, market intelligence platform Santiment reported that the 3.1% CPI result caused market cap losses in cryptocurrency and equities markets. The Bitcoin price, which had breached the $50,000 mark for the first time in over two years, has fallen below $49,000 in response.

According to the crypto platform’s analysis, this mild retrace will likely polarize crowd sentiment, potentially leading to significant panic sales. In such a scenario, the justification for dip buying becomes more viable, but sentiment may turn negative.

Bitcoin’s Market Cycle Patterns

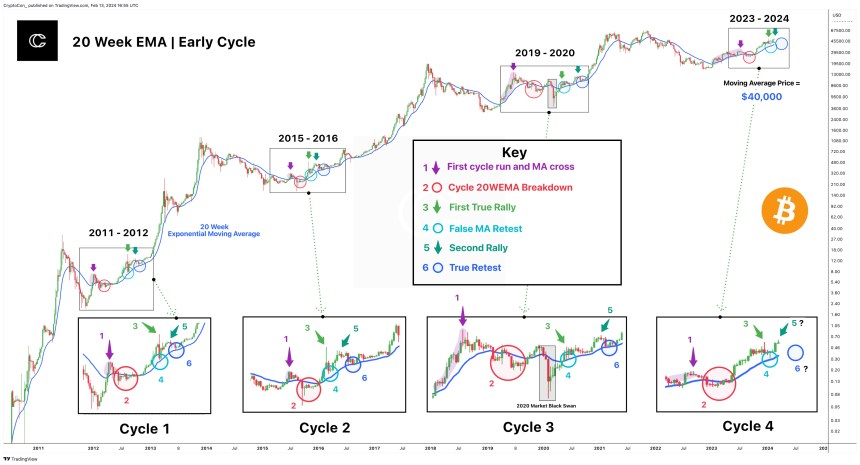

Market expert Crypto Con has identified a striking pattern in Bitcoin’s market cycles, specifically concerning the 20 Week Exponential Moving Average (EMA). Despite mounting concerns regarding inflation data, the analysis suggests that the Bitcoin price behavior tends to follow a consistent six-step pattern, with significant implications for support and potential correction levels.

According to Crypto Con’s analysis, Bitcoin’s price movement in each market cycle has adhered to a similar pattern involving the 20-week EMA. The pattern unfolds as follows:

First, as seen in the chart below, the Bitcoin price breaks above the moving average, marking the beginning of a new cycle and a notable uptrend. However, after the completion of the initial run, the price retraces and falls below the moving average, signaling a temporary shift in sentiment.

Despite the temporary setback, Bitcoin’s price then breaks above the moving average once more, indicating the start of a true rally and resumption of the upward trend. At this stage, price action creates a false retest of support, narrowly missing the moving average as a crucial support level. This false retest is a common occurrence in Bitcoin’s market cycles.

BTC’s market cycles and the importance of the 20 week EMA. Source: Crypto Con on X

BTC’s market cycles and the importance of the 20 week EMA. Source: Crypto Con on X

Following the false retest, Bitcoin embarks on a second run, representing a further advancement in the market cycle. Bitcoin’s price is currently positioned during this phase.

According to the analysis made by Crypto Con, the full correction in Bitcoin’s price may not need to be as deep, as the moving average currently sits at approximately $40,000.

Ultimately, the analysis’s suggestion that the Bitcoin price may not dip below the $40,000 level during the ongoing bull run, even in the face of anticipated corrections, is particularly encouraging for bullish investors.

Bitcoin is trading at 48,600, down 3% in the last 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

1 year ago

71

1 year ago

71