ARTICLE AD

Pro-XRP lawyer Bill Morgan has updated his assessment for the likelihood of a SEC appeal in the Ripple case. His reassessment follows closely on the heels of the ruling in the SEC’s case against Kraken, where US District Judge William H. Orrick III made a decision that might have significant implications for the SEC’s ongoing enforcement actions against the crypto industry.

In that case, Judge Orrick sided with the SEC, reinforcing the application of the Howey test — the cornerstone of US securities law that determines whether an asset qualifies as an investment contract — to digital assets. Morgan highlighted that Judge Orrick, in his ruling, explicitly supported the approach taken by Judge Analisa Torres in the Ripple case and Judge Amy Berman Jackson in the SEC’s case against Binance.

Pro-XRP Lawyer Lowers Appeal Odds To 55%

Morgan noted, “I am increasingly less confident that the SEC will appeal the Ripple summary judgment decision if merely legal considerations are influencing the decision whether to appeal. I pointed out in a post yesterday that Judge Orrick in the Kraken case preferred the approach of Judge Jackson in the Binance case and Judge Torres in the Ripple case that distinguishes between primary and secondary market transactions.”

The commentary underscores a potential shift in the judicial understanding of crypto transactions, particularly how they are interpreted under the Howey test’s criteria for investment contracts. The third prong of the Howey test — whether an investment is made with an expectation of profits predominantly from the efforts of others — is crucial in these considerations.

He noted that “the favorable comments about aspects of Judge Torres’ reasoning in the Ripple summary judgment decision by Judges Orrick and Jackson should assuage doubts about the correctness of her decision raised by some critics such as Charles Gasparino.”

Morgan also highlights Judge Orrick’s commentary: “Judge Orrick points out that Judge Torres’ decision was ‘carefully constrained to the facts of the case and predicated on findings from a fully developed record,’ and was consistent in approach with the Ninth Circuit’s holding in the Hocking case.” This suggests a judicial examination tailored to the specifics of the Ripple case, potentially limiting the broader applicability of the decision to the broader crypto industry and thereby influencing the SEC’s potential decision to not appeal.

The pro-XRP lawyer concluded, “What is important to me is that if there is no obvious legal error and the SEC can easily distinguish the Ripple case because it is narrowly confined to its own facts why appeal it at all, unless of course there are non legal considerations influencing the decision to appeal.”

Community engagement on Morgan’s X post reveals a mixed reaction. When user Spirconi expressed confusion over Morgan’s assessment, Morgan clarified his stance: “I was 80-20% for an appeal. Now down to 55-45% for an appeal.”

Further, in response to another user’s comment on the SEC’s silence about the Ripple ruling, Morgan speculated, “The SEC may not have yet made up its mind either way.” Another user, @tes23ract, questioned whether the SEC could delay its decision until after the upcoming US elections, to which Morgan responded definitively, “No – there is a 60 day deadline starting on when the final orders were made.”

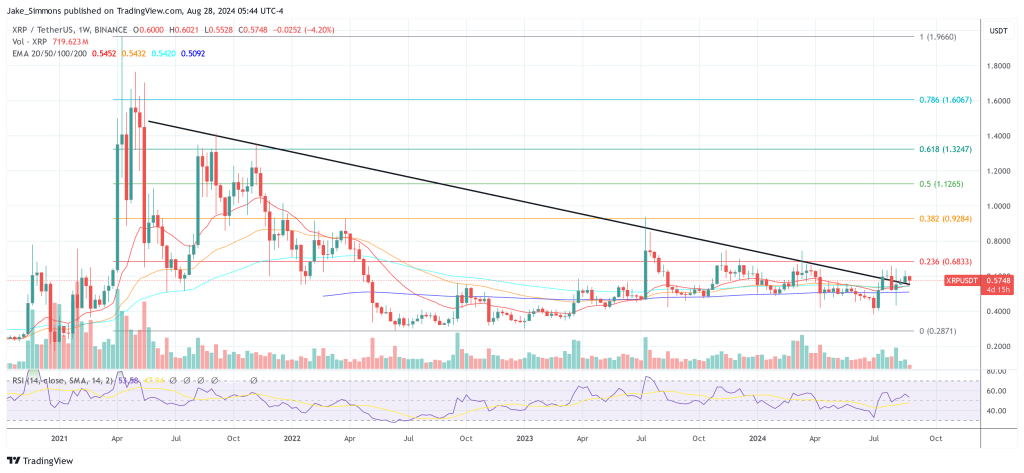

At press time, XRP traded at $0.5748.

XRP retests the trendline again, 1-week chart | Source: XRPUSDT on TradingView.com

XRP retests the trendline again, 1-week chart | Source: XRPUSDT on TradingView.com

Featured image created with DALL.E, chart from TradingView.com

3 months ago

13

3 months ago

13